Summary

- 10X Research said that last week's virtual asset market trading volume was the lowest since July.

- Bitcoin and Ethereum trading volumes fell by 31% and 43% compared with the average, respectively, and on-chain activity was also extremely low.

- Ethereum futures funding rate surged to 20.4% and open interest increased, while Bitcoin futures open interest decreased.

Last week, the virtual asset (cryptocurrency) market showed the lowest trading activity since July.

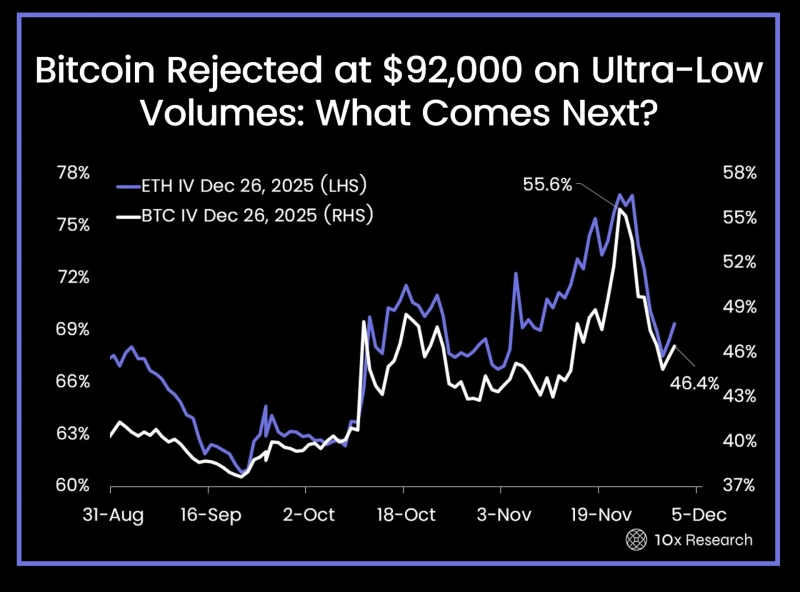

On the 1st (local time), 10X Research said in a report, "Last week the virtual asset market recorded the lowest trading volume since July. Despite strengthened expectations of interest rate cuts, Bitcoin (BTC) continued to underperform, failing once again to break the resistance near $92,000." the report said.

According to the report, the total virtual asset market capitalization was about $3.1 trillion, up 4% from the previous week, but the weekly average trading volume was $127 billion, down 32% from usual. Trading volumes for Bitcoin and Ethereum (ETH) also fell by 31% ($59.9 billion) and 43% ($21.1 billion) versus the average, respectively, and on-chain activity was observed to be extremely low as Ethereum network fees fell to around 0.05 Gwei.

A similar trend continued in the derivatives market. The funding rate for Bitcoin futures rose to 4.3%, placing it in the top 20% over the past 12 months, but open interest (OI) was recorded at $29.7 billion, down $1.1 billion.

Meanwhile, the funding rate for Ethereum futures surged to 20.4%, reaching the top 83%, and open interest increased by $900 million to $16.2 billion. Currently, Bitcoin·Ethereum futures open interest account for 56% and 72% of market capitalization, respectively.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)