"Altcoin liquidity is drying up… Projects that secured ETF or corporate financial asset inclusion have survival prospects"

공유하기

Summary

- Analysis has emerged that the liquidity of the altcoin market is rapidly decreasing.

- He said that among major projects, those that have secured external liquidity channels such as ETF approval or inclusion in corporate finances (DAT) have higher long-term survival prospects.

- He said projects not connected to ETF, DAT, or institutional channels have high long-term risk.

As liquidity in the altcoin market is rapidly decreasing, analysis suggests that projects that have secured external liquidity channels such as ETFs or inclusion in corporate financial assets are relatively more likely to survive.

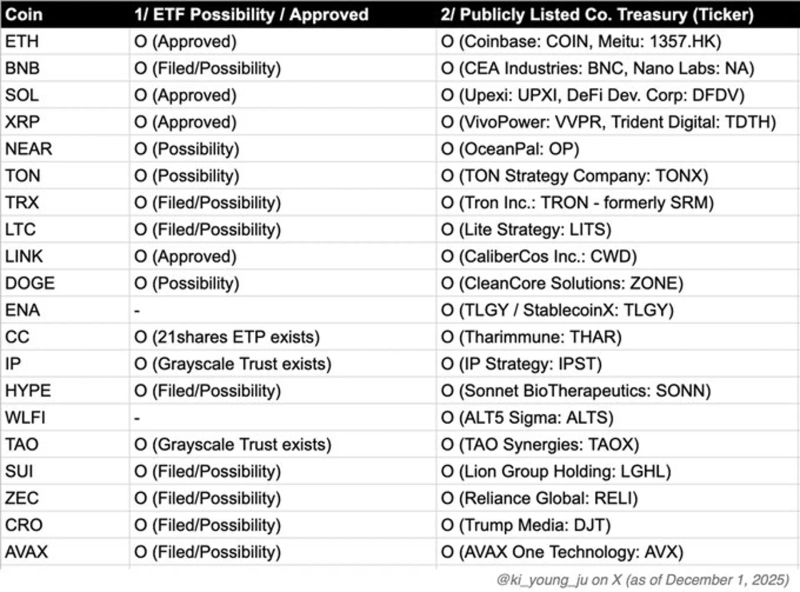

On the 1st (local time), Ju Ki-young, CEO of CryptoQuant, wrote on X (formerly Twitter) that "altcoin liquidity is drying up," and said "projects that have secured ETFs or corporate financial strategies like Digital Asset Treasury (DAT) have a higher chance of long-term survival." DAT refers to a strategy where a company reserves a specific coin as a financial asset.

According to materials Ju released, major assets such as ETH, SOL, XRP, LINK have already been approved for spot ETFs or have been included as financial assets of listed companies. In addition, BNB, NEAR, TON, TRX, LTC, DOGE are classified as projects that are being discussed for ETF approval or are securing initial liquidity through trust products.

He emphasized, "After all, altcoins are a liquidity battle," and "projects that are not connected to ETF, DAT, or institutional channels have high long-term risks."