[Analysis] "Bitcoin plunges due to BOJ rate-hike prospects and liquidation pressure in the derivatives market"

Summary

- It stated that recent sharp declines in Bitcoin prices were mainly due to speculation about a possible rate hike by the Bank of Japan (BOJ) and the resulting deterioration of market sentiment.

- It reported that yen strength and carry trade liquidation together accelerated selling of global risk assets and the liquidation of Bitcoin derivative positions.

- It forecasted that if the BOJ's actual rate decision announcement reduces uncertainty, the market is likely to gradually stabilize.

Bitcoin (BTC) has reportedly experienced a sharp correction recently due to the possibility of a policy shift at the Bank of Japan (BOJ).

On the 2nd (local time), CryptoQuant author Xwin Research Japan explained, "As observations spread that BOJ Governor Ueda could signal a possibility of a rate hike on December 1, market sentiment quickly contracted, and the yen turned strong, increasing selling pressure across global risk assets."

He added, "The expectation of a policy shift around the Nagoya speech further gained prominence, causing the yen carry trade that had persisted for years to begin unwinding. In early December, in the derivatives market, funding rates rapidly turned negative, and thereafter the negative extent widened, making short positions clearly dominant. This was a factor that reinforced short-term selling."

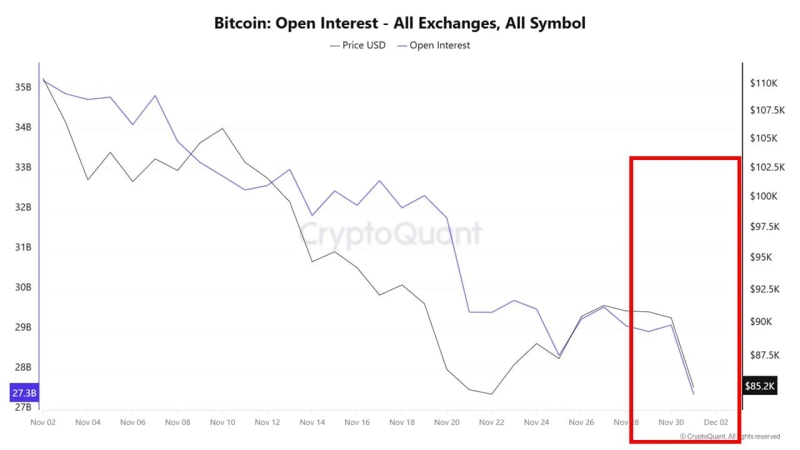

Open interest (OI) also decreased rapidly from the same time. The total OI falling from the low $3 billion range to the $2.7 billion range in two days suggests that forced liquidations and voluntary deleveraging occurred simultaneously.

The author said, "The sequence 'BOJ rate-hike expectations → yen strength → carry trade liquidation → Bitcoin derivatives position unwinding' amplified downward pressure," and projected that "if the BOJ's actual rate decision is announced and uncertainty is alleviated, the market is likely to gradually move into a stabilization phase."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)