Summary

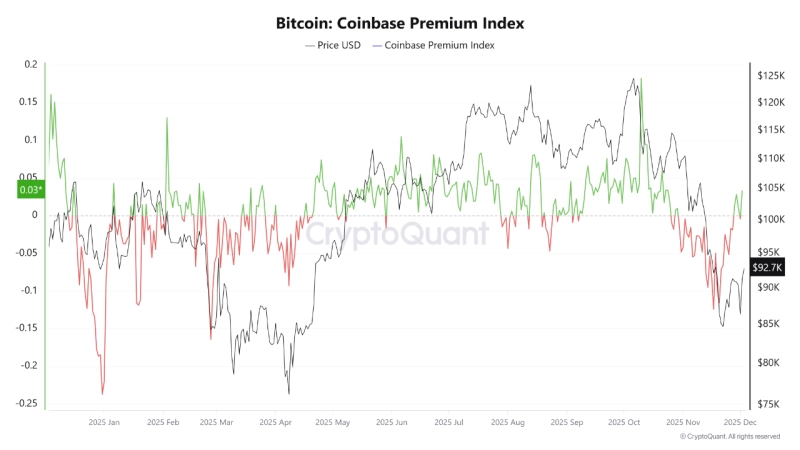

- Recently, the 'Coinbase Premium' indicator turned positive and is interpreted as a signal of buying inflows from U.S. investors.

- It analyzed that when key indicators such as Coinbase Premium and Binance liquidity align, the market tends to enter a pre-rally consolidation phase.

- If the premium is maintained, there is a possibility that a market uptrend is being prepared; if it falls, short-term selling pressure may increase.

An analysis said Bitcoin (BTC) price is building a new price base before entering an uptrend.

Arab Chain, a CryptoQuant contributor, said on the 3rd (local time) via CryptoQuant, "The 'Coinbase Premium' indicator has shown clear changes in recent days," and "Although selling pressure from U.S. investors continued throughout last month, (the Coinbase Premium) has returned to a positive territory of 0.03." The Coinbase Premium is the figure obtained by subtracting Binance's Bitcoin price from Coinbase's Bitcoin price on the U.S. crypto exchange, and is regarded as a key indicator to gauge U.S.-origin Bitcoin buying pressure.

Arab Chain analyzed, "Historically, when the Coinbase Premium turns positive, U.S. institutional demand tends to flow back in," adding, "because Coinbase serves as a key gateway for U.S. liquidity." Arab Chain continued, "Other indicators such as Binance's spot and perpetual futures trading volumes show that global liquidity is gradually responding to the Coinbase Premium's rise," and "When the signals of the two platforms align, the market generally tends to enter a pre-rally consolidation phase."

Arab Chain also mentioned the possibility of further gains. Arab Chain analyzed, "The interaction of the two key indicators, the Coinbase Premium and Binance liquidity, is a signal that the market price structure has begun to gradually improve," and "If the trend persists, the market may be preparing for a new uptrend." Arab Chain added, "(However) if the Coinbase Premium falls again, market volatility could intensify again and the market could return to a phase where short-term selling pressure increases."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)