Summary

- Recently Bitcoin ELR has declined, easing the market's leverage overheating.

- Arab Chain said that the ELR's 30-day low record reduces the market's sudden liquidation risk and increases the stability of the price uptrend.

- As a result, investors are maintaining sustainable futures positions instead of aggressive borrowing, and support in the low-$90,000 range is being strengthened.

Bitcoin (BTC)'s 'Estimated Leverage Ratio (ELR)' is showing a decline. Analysis suggests a structural foundation for Bitcoin price gains is being established.

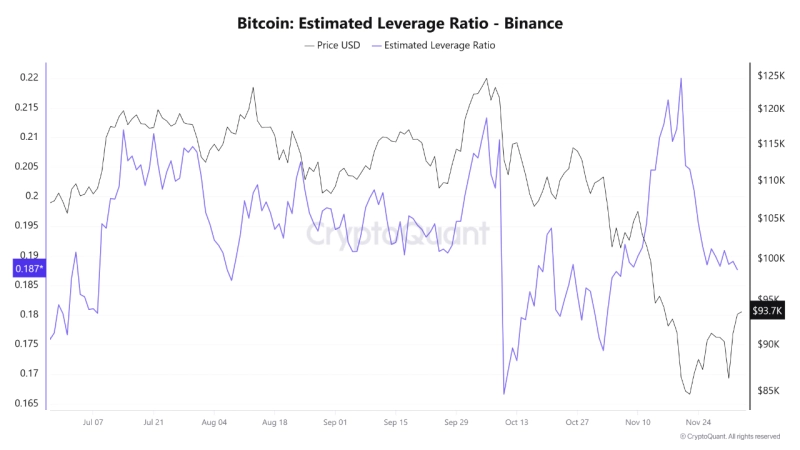

An Arab Chain CryptoQuant contributor wrote on CryptoQuant on the 4th (local time), "While the Bitcoin price rises to $93,000, Binance's ELR continues to decline," and said, "Binance's latest ELR, the world's largest platform by spot and futures trading volume for Bitcoin, is a figure that shows structural changes in the market." ELR is an indicator that shows how large the open interest (OI) in the futures market is compared to the exchange's crypto holdings. Generally, the higher the ELR, the more overheated leverage is considered in the market.

Arab Chain noted, "While Bitcoin rose to the $93,000 level, ELR fell to 0.187." Arab Chain said, "This is roughly a one-month low," and added, "The rare divergence between price and leverage provides important implications for interpreting the current flow." It also analyzed, "That ELR has fallen to a 30-day low means that high-risk leveraged positions have been significantly reduced," and, "Healthy deleveraging lowers the market's sudden liquidation risk and reinforces the stability of the current price uptrend."

Arab Chain viewed that the easing of leverage overheating increases the possibility of further Bitcoin price rises. Arab Chain said, "In such an environment, there is generally a shift in the derivatives market toward lower-risk positions," explaining, "It means investors are participating in the market by maintaining sustainable futures positions rather than aggressive borrowing." It added, "As a result, the market becomes less vulnerable to large-scale cascade liquidations, and price movements form on a firmer basis," and, "This will strengthen support in the low-$90,000 range and make the current uptrend a more solid flow that is less dependent on short-term leveraged speculation."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)