Editor's PiCK

Tom Lee "Ethereum $62,000 · Bitcoin $300,000 Forecast… Crypto Bull Market Hasn't Even Started" [BBW2025]

공유하기

Summary

- Tom Lee, chairman of BitMine, said Bitcoin could rise to $300,000 next year and Ethereum to $62,000.

- He said that despite recent price weakness, "now is actually a period with upside open," and that Ethereum is the payment rail of future finance, with real-asset tokenization actively taking place on smart contract platforms.

- Tom Lee emphasized that digital asset treasury companies can sometimes offer higher leveraged returns than coins and urged attention to Ethereum and digital asset companies.

Tom Lee, chairman of BitMine and known as a Bitcoin bull, once again raised his price forecasts for Ethereum and Bitcoin. He said, "The crypto supercycle is still valid," and "Bitcoin could reach $300,000 next year, and Ethereum could go up to $62,000." Despite recent corrections and pessimism, his view is that "now is actually a period with more upside open."

Tom Lee currently serves as head of research at Fundstrat and chief investment officer (CIO) of Fundstrat Capital, and also serves as chairman of the board of BitMine Emergent Technologies, considered one of the largest holders of Ethereum. He emphasized, "Over the past 10 years Bitcoin has risen 112-fold and Ethereum nearly 500-fold, but this is not the end but the beginning," and "the next 10 years, as Wall Street fully embraces tokenization, will be much bigger."

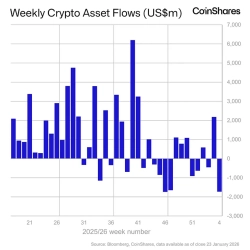

Regarding the recent price adjustment, he described it as an 'indescribable sell-off.' He said, "Gold has risen 61% year-to-date and the S&P index has risen nearly 20%, but Bitcoin and Ethereum are in negative territory," and "especially since October 10 record liquidation and deleveraging overlapped, so looking only at the charts it feels like winter, but the fundamentals are the exact opposite." He added, "Even during the FTX collapse it took market makers eight weeks to recover, and the timing is similar now," and explained, "We reduced Ethereum purchases and then increased them aggressively again."

He ruled out the idea that this cycle will end with a 'four-year cadence' as in the past. Tom Lee said, "Bitcoin has so far made peaks and troughs in a four-year cadence three times in a row, but indicators that used to explain this cycle—like the copper-to-gold ratio or the U.S. manufacturing index (ISM)—no longer follow a four-year rhythm," and argued, "Since industrial and economic cycles have changed, it's hard to see Bitcoin repeating the same pattern." He added, "We expect Bitcoin to rewrite its all-time high in early next year, and to be near $300,000 by the end of next year."

He described Ethereum as "the payment rail of future finance." He said, "Tokenization started with stablecoins, but now it's the process of moving not only dollars but also stocks, bonds, real estate and all financial assets on-chain," and "Ethereum is the smart contract platform that all of this will ride on." He also noted that a significant number of traditional financial firms' real-world asset (RWA) tokenization projects are being conducted on Ethereum.

His specific price forecasts are more aggressive. Tom Lee said, "I think Bitcoin could reach $250,000 within the next few months," and "if Ethereum only rises to the historical eight-year average Bitcoin-relative ratio, it would be $12,000." He continued, "If it recovers to the 2021 peak ratio it would be $22,000, and if tokenization and its role as a payment rail become fully prominent and market cap follows to about 25% of Bitcoin, Ethereum could reach $62,000," arguing, "Ethereum, currently around $3,000, is extremely undervalued."

He also said investors should pay attention to 'digital asset treasury' companies rather than just coin investments. Tom Lee said, "Digital asset treasury companies like MicroStrategy and BitMine can sometimes provide higher leveraged returns than coins." He explained that BitMine already aims to secure Ethereum up to about 5% and that through its own staking solution it could generate roughly $400 million in annual net profit. He added, "Wall Street will combine tokenization, prediction markets, and smart contracts to create entirely new-structured financial products, and in that process Ethereum and digital asset treasury companies will be core pillars."