Editor's PiCK

Turbulent stablecoin market… RLUSD and PayPal USD emerge as rising contenders

Summary

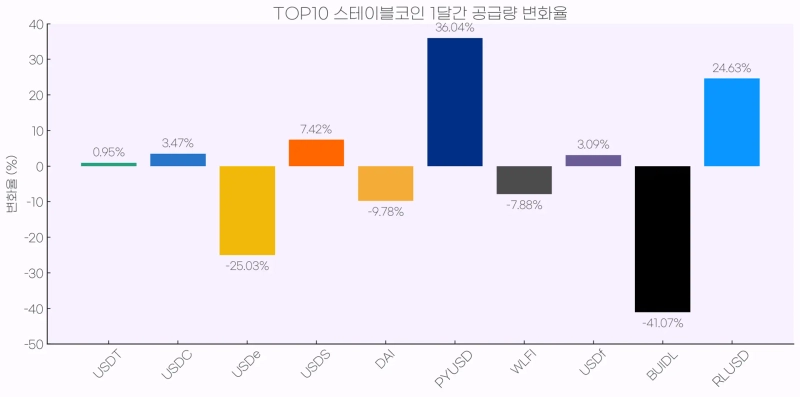

- Over the past month, PYUSD and RLUSD saw their supplies increase by 36.04% and 24.63%, respectively, showing notable growth in the stablecoin market.

- The two stablecoins have strengthened their positions by significantly expanding use cases through a multi-chain strategy and rapid real-world adoption.

- PYUSD and RLUSD are challenging the existing Tether and USDC duopoly, intensifying competition in the stablecoin market.

The supplies of PayPal USD (PYUSD) and Ripple RLUSD have surged over the past month. Analysts say the intensifying global stablecoin competition could bring changes to the market structure that has solidified around the Tether (USDT) and Circle (USDC) duopoly.

On the 4th (Korean time), BloomingBit analyzed DefiLama data and found that among the top 10 stablecoins by market capitalization, PYUSD saw the largest increase in supply (market cap) over the past month. PYUSD's supply stood at $3.82 billion as of that day, a 36.04% surge in the past month. Boosted by this growth, PYUSD has entered the top 30 by total crypto market capitalization.

PYUSD's supply was only $1.28 billion as of last September. Its market cap has thus risen more than 300% in the past three months.

The second-largest supply growth rate was RLUSD (24.63%). RLUSD is the stablecoin Ripple, the issuer of XRP, launched in December last year. In less than a year since its launch, it surpassed $1 billion in market cap and joined the ranks of major stablecoins.

By contrast, Tether and Circle saw supply growth rates of only 0.95% and 3.47%, respectively, over the same period.

Some stablecoins saw their supply shrink. The synthetic dollar stablecoin USDe from Etena (ENA) saw its market cap fall 25.03% over the past month. BlackRock's money market fund (MMF) BUIDL saw its market cap plunge 41.07%.

'Multi-chain strategy' hits the mark

PYUSD and RLUSD share the strategy of expanding utility by strengthening connectivity with various blockchain networks.

First, PYUSD accelerated multi-chain expansion when PayPal integrated LayerZero (ZRO) cross-chain transfers in September. LayerZero created a stablecoin PYUSD0, exchangeable 1:1 with PYUSD, and deployed it across nine mainnets including Appstract, Aptos (APT), and TRON (TRX). As a result, PYUSD's use cases, which had been limited to four networks—Ethereum (ETH), Solana (SOL), Arbitrum (ARB), and Stellar (XLM)—expanded significantly to 13.

Also, the launch of a P2P remittance feature called 'links' within PayPal subsidiary Venmo's app, increasing actual payment flows, is analyzed to have positively influenced PYUSD supply expansion.

RLUSD's use cases are rapidly expanding based on Ethereum. RLUSD is issued on the XRP Ledger (XRPL). However, $1.046 billion, or 82% of the total supply, is circulating on the Ethereum network.

RLUSD's prominence in Ethereum-based decentralized finance (DeFi) has been a major factor. RLUSD is currently listed on leading Ethereum-based DeFi protocols such as Curve and Uniswap (UNI). Curve's USDC–RLUSD pool liquidity stood at $74 million as of that day.

Is the 'duopoly' showing cracks?

The market is watching whether the rise of emerging stablecoins like PYUSD and RLUSD can dent the dominance of Tether and USDC, which have long divided the market between them.

In particular, regulatory risk has recently emerged as a factor for Tether. Earlier, international credit rater S&P Global downgraded Tether's stablecoin risk rating from 'constrained' to 'weak.' The 'weak' rating is the lowest in S&P's crypto assessment scale. The downgrade was due to a lack of transparency in Tether's reserves and a high proportion of high-risk assets such as Bitcoin (BTC), gold, and corporate bonds.

If competition intensifies, USDC's market share could be significantly affected. Circle's stock price plunged from $289.99 in June to the recent $70–$80 range.

Analysts say that intensified stablecoin market competition has put downward pressure on market share, contributing to the stock decline. This context also underpinned U.S. investment bank Compass Point's July downgrade of Circle's investment opinion to 'sell.'

An industry source said, "What matters most in the stablecoin market is utility," adding, "The expansion of PYUSD and RLUSD should be interpreted as a signal that structural change is occurring in the market, not merely an increase in supply."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)