On-chain, Tokenization, AI... Abu Dhabi Declares Global Financial Paradigm Shift [ADFW 2025]

Summary

- The UAE announced it has begun full-scale global financial structural change centered on digital financial infrastructure innovation, on-chain, stablecoins, and AI integration.

- Global exchanges like Binance said that tokenization market growth, stablecoin payment spread, and increased institutional adoption will continue to form strong growth momentum next year.

- Coinbase and Circle said that the on-chain transition of global financial infrastructure and a clear regulatory environment are driving mass adoption and spread.

UAE Presents Blueprint for Digital Financial Infrastructure Innovation

Stablecoins, Tokenization Spread… On-chain Finance Accelerates

Next-generation Financial Structural Shift Combining AI Begins in Earnest

The 'Abu Dhabi Finance Week 2025 (ADFW 2025)' held in Abu Dhabi, United Arab Emirates (UAE), concluded successfully on the 10th (local time). The event was attended by the UAE financial authorities, global exchanges, web3 companies, and many others who continued discussions about the future of finance.

A common theme of this year's event was the 'on-chain-based reorganization' of global financial infrastructure. From the spread of stablecoin payments to tokenization, AI-based finance, and nation-level digital financial infrastructure innovation, a trend of fundamentally redefining the global financial order ran throughout the program.

UAE "Leap to a Digital Financial Hub… Accelerating AI- and Data-based Innovation"

Paul Kairuz, the UAE Central Bank's Chief FinTech Officer, who took the podium that day, clearly presented the UAE government's financial infrastructure transition strategy.

He said, "The UAE will become a hub where the future of digital finance is concentrated," and emphasized, "Nationwide financial structural innovation is already yielding tangible results." He added, "Everyday financial functions such as payments, remittances, and accounts are rapidly being reorganized in digital ways," and, "This is not merely efficiency gains but a structural transformation of the entire financial ecosystem."

He also announced plans to build an 'innovation bridge' connecting government, financial institutions, and technology companies. Through this platform, various players will be supported to develop, verify, and collaborate on services within a single framework, which is evaluated as core infrastructure for the UAE to advance as a global digital financial center.

He explained, "AI will fundamentally redefine the efficiency of financial services," and, "Sophisticated data infrastructure becomes the basis for regulatory, risk management, and tailored financial service innovation." He added, "The central bank is also enhancing its policy and technical foundations to lead these changes."

Binance "Digital assets are already part of global markets… Growth will continue"

The following session continued discussions about the speed at which the digital asset market is being integrated into the actual financial system.

Richard Teng, Binance co-CEO, said, "The recent adjustment in the digital asset market is not solely a digital asset issue but a flow intertwined with broader global asset market volatility," and added, "Digital assets are now part of the global capital market, not an isolated market."

He explained, "The spread of stablecoin payments, increased institutional adoption, and the growth of the tokenization market will form strong growth momentum based on real use cases next year," and, "The pattern of the digital asset market is to build a foundation over a long period and then see sudden explosive mass adoption. Stablecoins have existed for a long time, but large-scale mass adoption has only recently started in earnest."

Regulatory clarity was cited as a key factor for wider adoption. Teng said, "With the organization of a global regulatory framework, more than 12,000 merchants have begun accepting digital asset payments," and, "Back-office institutional finance tasks such as accounting, reconciliation, and settlement will also be redesigned on a blockchain basis."

He also said, "No one can predict whether next year will be a 'super cycle' beyond the traditional four-year cycle," but expressed confidence, "However, as regulatory clarity and global partnerships expand, the industry's structural momentum remains strong."

Coinbase · Circle "Global finance trend toward on-chain transition is accelerating"

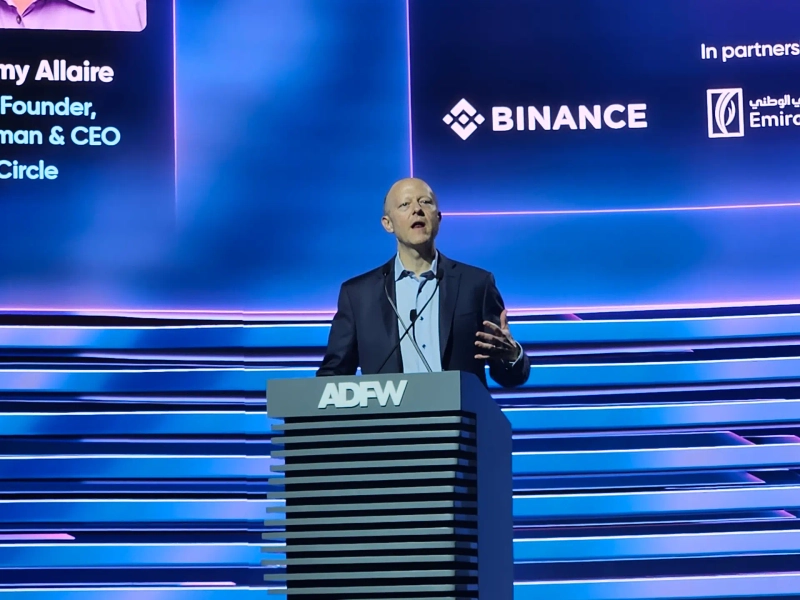

The acceleration of the on-chain transition was repeatedly mentioned in remarks by Brian Armstrong, Coinbase CEO, and Jeremy Allaire, Circle CEO. They jointly said, "Over the coming decades, global financial infrastructure will be reorganized around on-chain systems."

Armstrong said, "As payment and settlement infrastructure moves on-chain, costs and time are being dramatically reduced," and diagnosed, "On-chain finance is redesigning the global financial system." He explained that 'tokenization,' which issues and circulates assets on-chain, increases financial accessibility and offers cheaper and simpler structures than traditional finance. The UAE's clear regulatory environment was also cited as a factor accelerating this transition.

Allaire also said, "Global financial infrastructure is being reorganized into new forms as it combines with on-chain systems," and, "Governments, banks, technology companies, and payment networks are all participating in the transition to on-chain systems."

He emphasized that USDC on-chain transaction volumes have already grown to an annual scale of US$6.8 trillion to US$10 trillion, saying stablecoins are the central axis of on-chain finance proliferation.

He continued, "If AI agents become deeply integrated into finance, billions of AI agents will carry out real-time economic activities," and explained, "The core foundations enabling this are on-chain assets, data, and payment infrastructure."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.