Fidelity "Bitcoin's 4-year cycle may be coming to an end…possibility of entering a supercycle"

Suehyeon Lee

Summary

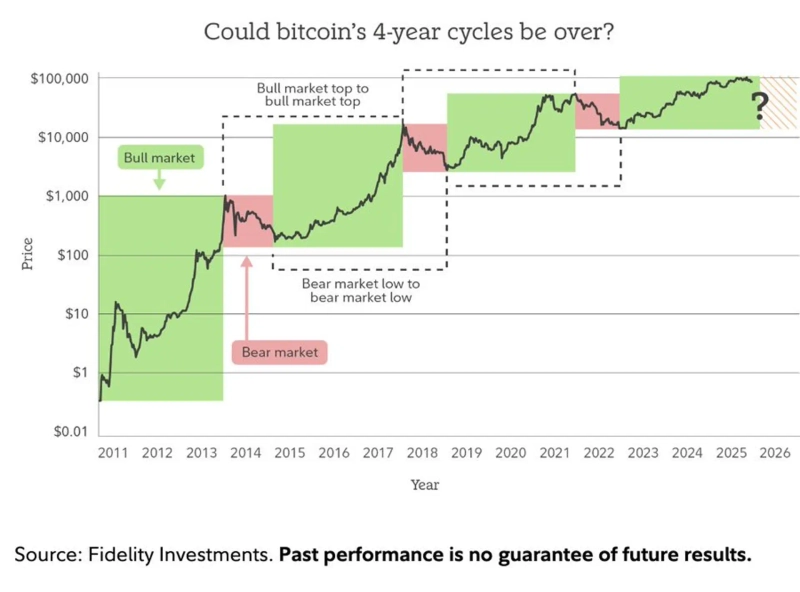

- Fidelity Digital Assets said the existing 4-year cycle structure of Bitcoin is weakening.

- The report said some investors are noting the possibility that Bitcoin could move beyond the traditional halving cycle and enter a long-term upward phase.

- Referencing past cases of commodity supercycles, it said Bitcoin could also have the potential for long-term gains due to structural demand increases and changes in the macro environment.

The long-held conventional 4-year cycle structure in the Bitcoin (BTC) market is weakening, and instead there is an analysis that it may be entering a long-term 'supercycle' phase.

On the 16th (local time), according to Bitcoin Magazine, Fidelity Digital Assets said in a recent report, "Some investors see the possibility that Bitcoin could move beyond the existing halving-based 4-year cycle and enter a longer-term upward phase."

The report compared this to past cases in the commodity markets. It noted that the commodity supercycle of the early 2000s lasted about 10 years, and that structural demand increases and changes in the macro environment driving long-term gains have similarities to Bitcoin.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.