"Small- and mid-cap altcoin season may be difficult next year… funds will move only to top coins"

공유하기

- Next year, an across-the-board altcoin rally like in the past will be difficult, and funds are likely to flow only into some top virtual assets.

- CoinX forecasted that Bitcoin could target 180,000 dollars by 2026, while also noting that, due to parabolic corrections, it could fall to 25,000 dollars.

- They assessed that Bitcoin has fallen more than 20% this fourth quarter and is showing a weaker trend than in the past.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Next year, it is expected to be difficult for an across-the-board altcoin rally like in the past, and funds may flow selectively only into some top virtual assets (cryptocurrencies).

On the 23rd, according to virtual asset specialist media Cointelegraph, Jeff Ko, chief analyst at CoinX Research, said, "There will be no altcoin season in the traditional sense in 2026," and added, "Liquidity is likely to move only into a small number of blue-chip virtual assets that have proven real adoption and survivability."

He said, "Retail investors expecting all altcoins to rise together may be disappointed," and predicted, "Fund flows will move much more selectively than before."

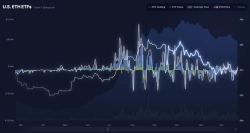

Regarding the macro environment, he assessed, "There is a possibility that global liquidity conditions will improve moderately in 2026, but upside momentum will be limited as policy stances among major central banks diverge." However, he evaluated that "in the case of Bitcoin, the correlation with increases in the money supply has weakened compared with the past since the launch of spot ETFs last year."

Under this premise, CoinX also presented a baseline scenario in which Bitcoin could target 180,000 dollars by 2026.

On the other hand, a more conservative view exists. Veteran trader Peter Brandt said, "Bitcoin has, over the past 15 years, repeatedly experienced corrections of at least 80% after five parabolic rallies," and added, "The current cycle is not yet over, but the peak of the next bull market could be around September 2029."

This ties in with the so-called four-year cycle theory, in which a peak forms about one year after the halving. However, some observers note that if a similar correction to the past repeats, Bitcoin's price could fall to around 25,000 dollars.

Historically, the fourth quarter has been considered favorable for Bitcoin, but this year's fourth quarter Bitcoin has so far fallen more than 20% and is showing an unusually weak trend. Some market participants interpret this as a process of excessive risk positions being liquidated.

As of that day, Bitcoin was trading around 88,000 dollars, about 30% below the all-time high recorded in October.

![[Blooming Lunch] Chaerin Kim "Blockchain still has many opportunities to become a pioneer"](https://media.bloomingbit.io/PROD/news/f97d8e94-07f3-4ef7-a8b9-45e04d9bf5e1.webp?w=250)