Emerging countries' 'silent default'…61 countries pay over 10% of government revenue in interest [Global Money X-File]

Summary

- Reported that several emerging countries have effectively entered a state of debt default (default), sharply increasing external debt repayment burdens.

- Stated that major emerging countries such as Bolivia, Kenya, Ethiopia, and Egypt face sharp declines in foreign exchange reserves and an increasing interest burden relative to government revenue, threatening economic stability.

- Said that global supply chain instability and the strengthening dollar caused by the emerging market crisis could have adverse effects on Korean exports and capital markets.

Recently, state defaults and social breakdowns have been spreading in the Global South, the emerging countries of the southern hemisphere. This is because prolonged high interest rates in advanced economies, a strong dollar, and accumulated debt have combined to create what is called a 'liquidity trap.'

'Silent default'

According to the World Bank and the International Finance Center, as of December many developing countries have not officially declared a debt default but have effectively entered a 'silent default' state, having lost the ability to repay their debts.

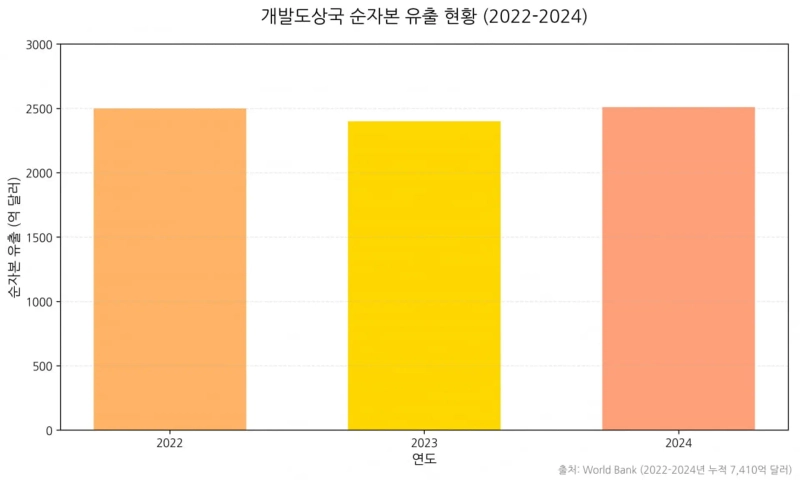

The World Bank estimates that net capital outflows from developing countries to creditors and advanced economies (debt repayments minus new loans) from 2022 through last year amounted to $741 billion. This is the largest amount in the past 50 years. The phenomenon of capital that developing countries should use for investment in economic growth being sucked away to repay advanced economies' debts has become entrenched.

Recent analyses link the emerging market crisis closely to the U.S. economy running alone. According to the U.S. Department of Commerce, real U.S. GDP growth in the third quarter was 4.3% annualized.

However, this U.S. 'exceptionalism' has had adverse effects on emerging markets. Because the U.S. economy is strong, the U.S. central bank (the Fed) has less reason to cut interest rates aggressively.

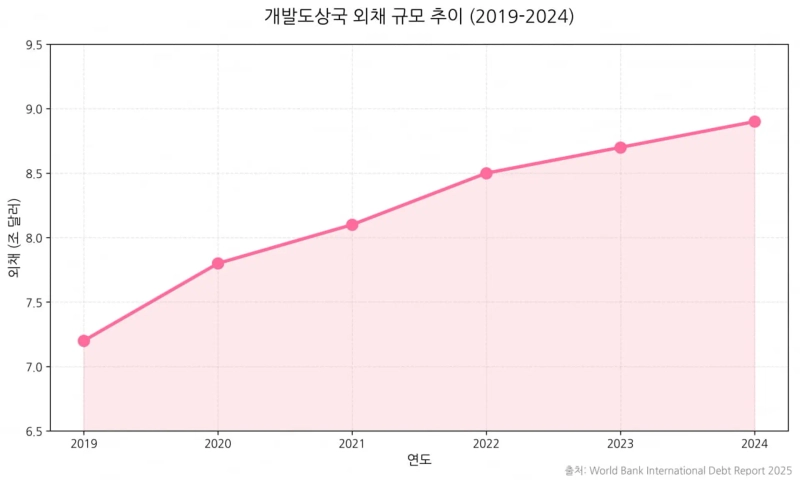

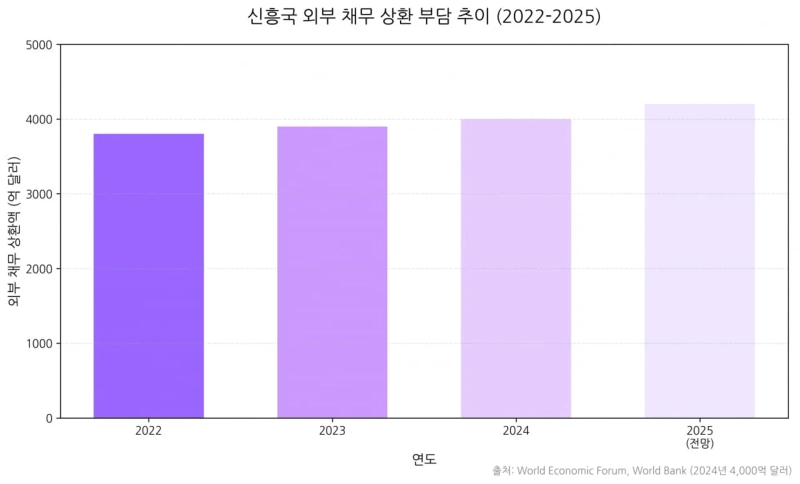

Ultimately, global funds have poured into high-yielding dollar assets in the United States, making it easy for emerging markets to have their financing channels blocked. Existing debt repayment burdens are expected to balloon like a snowball. As of last year, the external debt balances of low- and middle-income countries reached a record $8.9 trillion.

This crisis has erupted simultaneously across regions including South America, East Africa, and North Africa. Each country's crisis looks different. But the core factors are the same: 'dollar shortage' and the 'debt trap.'

The 'collapse' of resource-rich Bolivia

Bolivia, a resource-rich South American country, is a representative case where state functions were paralyzed by the depletion of foreign exchange reserves. Foreign exchange reserves that reached $15 billion in 2014 plunged by 99% to about $170 million as of last August. In effect, the state treasury is empty.

Bolivian President Rodrigo Paz abruptly abolished fuel subsidies that had been maintained for 20 years on the 19th to prevent fiscal collapse. As a result, diesel prices jumped 163% in one day from 3.72 bolivianos per liter to 9.80 bolivianos per liter. Gasoline prices also rose 86%.

Enraged transport unions and citizens poured into the streets, plunging major cities such as La Paz into a state of anarchy. In an interview with AFP, Bolivian small business owner Paulina Tankara said, "Bolivia's situation is a foreseeable tragedy," and angrily added, "Keeping subsidies that feed smugglers' coffers with $10 million a day has burned up the country's entire ability to pay."

According to the Central Bank of Bolivia, digital asset (cryptocurrency) trading volume in October was $24 million. Citizens who do not trust the local currency are hoarding Bitcoin or stablecoins (such as Tether) instead of dollars, attempting a kind of 'currency exile.'

Kenya, an economic hub in East Africa, is delaying default with financial techniques. But analysts say it is on the verge of collapse. The Kenyan government has been rolling over maturing eurobonds by issuing higher-interest bonds to repay them.

Kenya: 67% of tax revenue goes to 'debt party'

In October, Kenya issued 7-year and 12-year eurobonds to raise $1.5 billion. The interest rate reached 8.7% per year. They are using high-interest borrowing to pay previous debts. Currently, Kenya's debt servicing costs account for about 67% of total government revenue. If 100 won in taxes are collected, 67 won are used to pay interest. To cover this, last year the government pushed a 'finance bill' to tax bread and cooking oil, which sparked large-scale violent protests.

David Endi, economic advisor to the President of Kenya, pointed out, "Kenya is effectively under IMF receivership," and said, "We are borrowing to repay debt, and this means we have lost fiscal decision-making power as a sovereign state." He added, "This is not sustainable financing but close to a Ponzi scheme."

The adverse impact of the climate crisis compounded the situation. Infrastructure was destroyed by massive floods earlier this year, dramatically increasing recovery costs and further eroding already limited fiscal capacity.

Ethiopia is cited as showing the failure of the international debt restructuring system. After declaring default at the end of 2023, it negotiated with private creditor groups. However, talks collapsed in October. The Ethiopian government demanded an 18% reduction in principal. But the bondholder group composed of global asset managers such as BlackRock rejected the request, saying "Ethiopia's export performance has improved, so it has the ability to pay."

Eventually Ethiopia received $3.4 billion in rescue financing from the International Monetary Fund (IMF). However, critics say this is not a fundamental solution. Foreign direct investment (FDI) has shrunk to about 1.9% of GDP.

Egypt appears on the surface to have overcome the crisis. Early last year it signed a $35 billion 'Ras El Hikma' development deal with the UAE and increased IMF support to $8 billion to put out the immediate fire. In October, S&P also upgraded Egypt's credit rating.

However, analysts say the inside story is different. Egypt's core dollar pipeline, the Suez Canal, has been effectively blocked by Red Sea incidents (such as Houthi rebel attacks). Suez Canal revenues for the 2024–2025 fiscal year plunged 45.5% year-on-year to $3.6 billion.

Opportunity for structural reform vs social catastrophe

Some argue that the recent crisis is a chance to operate on emerging markets' chronic populist policies. Mainstream economists such as the IMF view Bolivia's fuel subsidy abolition or Egypt's fiscal tightening as necessary steps to restore fiscal soundness and improve economic fundamentals in the long term. The Bolivian government claims that eliminating subsidies could save $3 billion annually.

On the other hand, critics say abrupt austerity is leading to a 'social catastrophe.' According to the United Nations Conference on Trade and Development (UNCTAD), as of last year interest payments exceeded 10% of government revenues in 61 developing countries. The number of countries spending more on interest payments than on education rose to 22 by the education criterion and 45 by the health criterion.

The emerging market crisis is also argued not to be merely local instability. It acts as a factor increasing global economic uncertainty. First is the fragmentation of global supply chains. Instability in resource-rich countries like Bolivia (lithium) and Congo (cobalt) threatens supply chains for key industries such as electric vehicles.

Geopolitical risks also spread. Economic hardship causes political instability, which can lead to refugee problems or the spread of terrorism and increase security costs for advanced economies. There is also concern about an intensified 'dollar rush.' Emerging market turmoil stimulates safe-haven preferences, fueling dollar strength. This can in turn worsen emerging market debt burdens, creating a vicious cycle.

The Korean economy is also being adversely affected. Analyses say the overseas accounts receivable risk of major domestic construction firms has increased. According to the Ministry of Land, Infrastructure and Transport and industry data, domestic construction companies' overseas accounts receivable over the past three years are estimated at 5.2737 trillion won.

A reduction in emerging market purchasing power is a negative factor for Korean exports. If financial instability from emerging markets strengthens global safe-haven demand, foreign capital could withdraw from Korea's stock and bond markets.

Kim Juwan kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.