- It reported that the U.S. exchange-traded fund (ETF) market received a record $1.4 trillion in inflows this year.

- Both newly launched ETFs and trading volume reached record highs, with the growth of active ETFs standing out.

- Experts warned that preparations are needed for various risks, such as increased market volatility, amid the rapid growth.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Record numbers for new launches and trading volume

"Need to prepare for increased volatility, etc."

Concerns over rapid growth

The U.S. exchange-traded fund (ETF) market has experienced a record boom this year. Some market participants are voicing caution over the "record expansion."

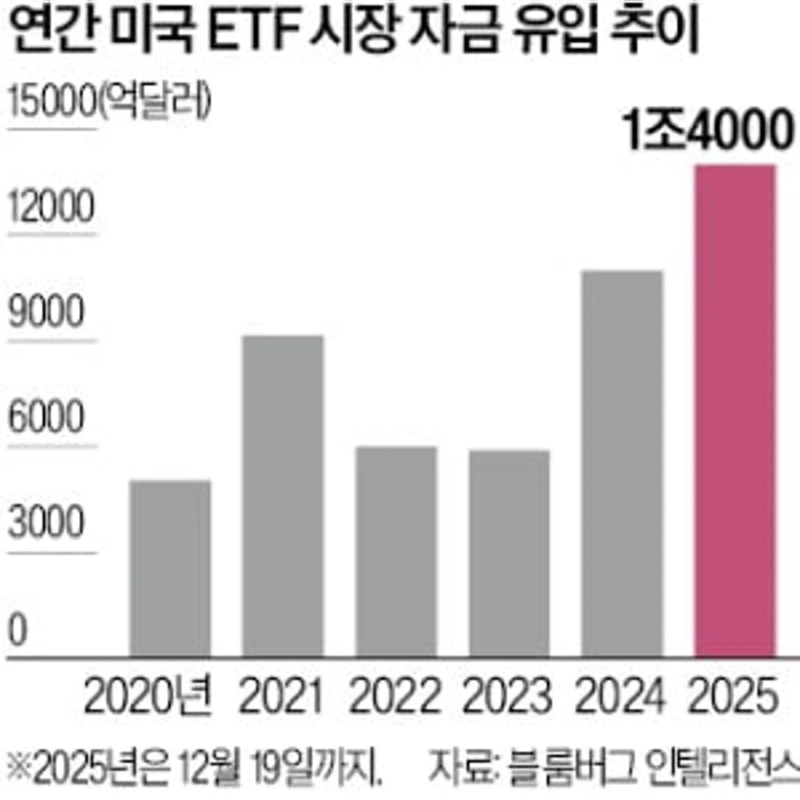

According to Bloomberg Intelligence, as of the 19th of this month, U.S.-listed ETFs set record highs across three key indicators: fund inflows, number of new products, and trading volume. This is the first time since 2021 — when liquidity surged after COVID-19 and an "investment boom" occurred — that all three indicators have simultaneously reached record highs in a single year.

Global funds flowing into U.S.-listed ETFs during this period amounted to $1.4 trillion (about KRW 2,037 trillion). This surpassed last year's previous record of $1.1 trillion.

Approximately 1,100 new U.S.-listed ETFs were launched this year, an increase of 51.72% year-on-year. Annual ETF trading volume also hit a record. Year-to-date trading amounted to $57.9 trillion (about KRW 84,152 trillion), up roughly 40% from last year. The growth of active ETFs was also notable. Active ETFs accounted for 84% of all new ETF launches and attracted more than 30% of total inflows into these products.

However, there are voices of concern about the rapidly growing ETF market. Eric Balchunas, a Bloomberg Intelligence ETF analyst, warned, "Next year there is a possibility that, in some form, a 'period to reassess the gap between expectations and reality' will arrive." He said, "Because the ETF market has had such a perfect year, it is a time to prepare," adding, "One should consider various risk scenarios, including increased market volatility, shocks from leveraged single-stock ETFs, and tax issues related to mutual-fund-based structures."

Reporter Seon Han-gyeol always@hankyung.com

!["0.04 seconds to trade execution"... Solayer dreams of a real-time financial platform [Coin Interview]](https://media.bloomingbit.io/PROD/news/562697c4-fa97-467a-b590-53f0bd87eff9.webp?w=250)

![Foreign exchange authorities conduct director-general-level 'verbal intervention' for first time in 1 year 8 months…Exchange rate drops 10 won [Hankyung FX Market Watch]](https://media.bloomingbit.io/PROD/news/ff01d6ae-341b-4a93-a671-6481856615a3.webp?w=250)