[Analysis] "Liquidity disappears while positions remain… virtual assets market, structural vulnerability ↑"

Summary

- 10x Research said total virtual assets trading volume and market capitalization have decreased, making market structure increasingly vulnerable.

- Bitcoin and Ethereum funding rates rose, but futures open interest fell, and leverage has not been fully unwound.

- It said the divergence among ETF flows, stablecoin activity, and futures positions is widening, and volatility could sharply increase even from small catalysts.

As the virtual assets (cryptocurrency) market continues to trade sideways, an analysis found that, despite the quiet flow, the structure is becoming increasingly vulnerable.

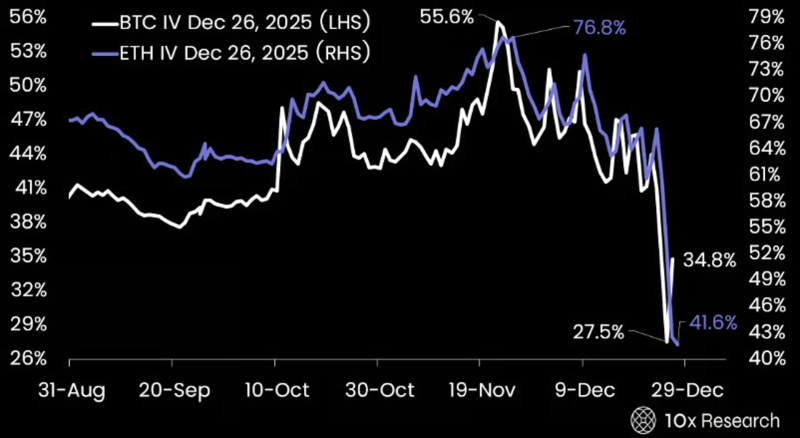

On the 29th (local time), 10x Research said in its weekly report that, after comprehensively reviewing Bitcoin and Ethereum derivatives positions, volatility, funding rates, exchange-traded fund (ETF) and stablecoin flows, and options market trends, the market appears stable but is in a state that could be shaken significantly by a small shock.

According to the report, total virtual assets market trading volume decreased by about 30% from usual. Total market capitalization was $2.96 trillion, down 0.7% from the previous week, and weekly average trading volume was $79 billion, a 26% decrease from the average. Bitcoin's weekly trading volume was $28.9 billion, 36% below the average, and Ethereum was $14.8 billion, down 32%. Ethereum network fees were around 0.04gwei, placing network utilization at a historically very low level.

By contrast, different movements were detected in the derivatives market. Bitcoin funding rates rose 3.7% on a weekly basis to an annualized 8.9%, corresponding to the 57th percentile over the past 12 months. Ethereum funding rates also rose 3.4% to 6.9%. However, futures open interest decreased for both Bitcoin and Ethereum, amounting to $27.3 billion and $17.7 billion, respectively. Leverage has partially unwound, but it has not fully come down to very low levels.

10x Research pointed to "the widening divergence among ETF flows, stablecoin activity, and futures positions" as a key risk factor. It explained that spot and network indicators are cooling, while derivatives and options markets are showing typical adjustment movements seen in a phase approaching a regime shift. Technical indicators also suggest the market is near a sensitive zone where small price moves could trigger position rebalancing.

The report diagnosed that "in an environment with thin liquidity, position structure rather than direction determines the next move," and warned that "a 1–2 week window in early next year could see volatility expand sharply on small catalysts." It emphasized that just because the market is quiet does not mean the risk has disappeared.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Stocks Whipsawed by Iran Crisis… “Money Moves Will Continue” [Weekly Outlook]](https://media.bloomingbit.io/PROD/news/dc1511ef-f8da-4fba-95dc-908afdb380f1.webp?w=250)