[Analysis] "Bitcoin correction phase, long-term holding capital absorbs the downside"

Summary

- "Bitcoin" market is analyzed to have downward pressure eased by inflows of capital with long-term holding tendencies during the corrective phase.

- The contributor said that long-term capital centered on 'accumulation addresses' is gradually leading the market, and this plays a buffering role during price declines.

- He stated that unless structural indicator improvements such as ETF fund flows and short-term holder profitability accompany the trend, prices are likely to continue a range-bound corrective movement for the time being.

The Bitcoin market is in a corrective phase, and analysis shows that inflows of capital with long-term holding tendencies continue, producing a structural change that eases sharp downward pressure.

On the 29th (local time), CryptoQuant contributor XWIN Research Japan said, "It is appropriate to interpret the current Bitcoin price movement as a corrective stage following a decline. The overall trend still leans toward cautious weakness, but subtle changes are being detected in the supply-demand structure," he diagnosed.

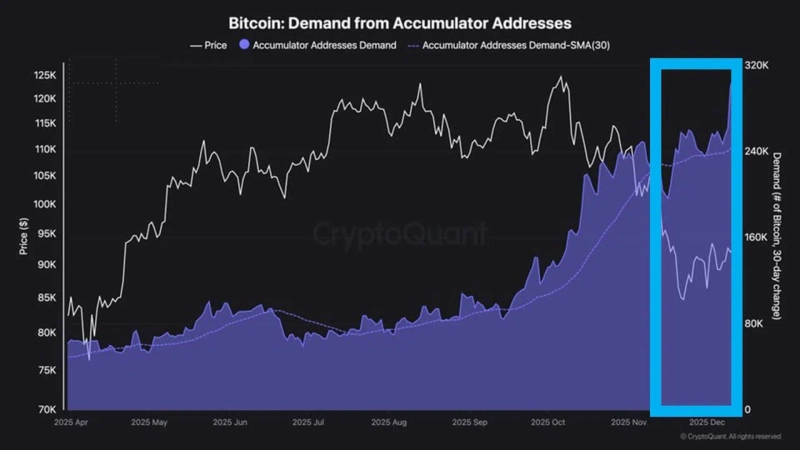

He particularly focused on the behavior of so-called 'accumulation addresses' that show strong long-term holding tendencies in on-chain data. These addresses are wallets with almost no meaningful history of selling, and they have steadily increased their Bitcoin holdings even in periods of heightened price volatility. This is interpreted as capital movement based on a long-term perspective rather than speculative buying aiming for short-term price rebounds.

In contrast, some individual investors are reducing risk exposure during the correction. The contributor analyzed, "The difference in behavior between these participants suggests that market leadership is gradually shifting from sentiment-sensitive funds to relatively patient capital."

However, he also noted that it is premature to interpret this flow as a signal of an immediate bullish reversal. Key structural indicators such as ETF fund flows, short-term holder profitability, and leverage structure in the derivatives market have not yet shown clear improvement. Accordingly, accumulation demand is more likely to serve as a buffer supporting the downside for the time being rather than driving price increases.

XWIN Research Japan added, "The base scenario is a phase in which long-term demand defends lower price ranges and the market finds balance. However, if accumulation intensity weakens or forced liquidations occur again, this stability could be shaken." They went on, "Unless accompanied by improvements in structural indicators, Bitcoin is likely to continue a range-bound corrective movement for the time being."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Stocks Whipsawed by Iran Crisis… “Money Moves Will Continue” [Weekly Outlook]](https://media.bloomingbit.io/PROD/news/dc1511ef-f8da-4fba-95dc-908afdb380f1.webp?w=250)