PiCK

[Analysis] "Bitcoin, Binance deposits increase again… signals overlapping with past sharp declines"

Summary

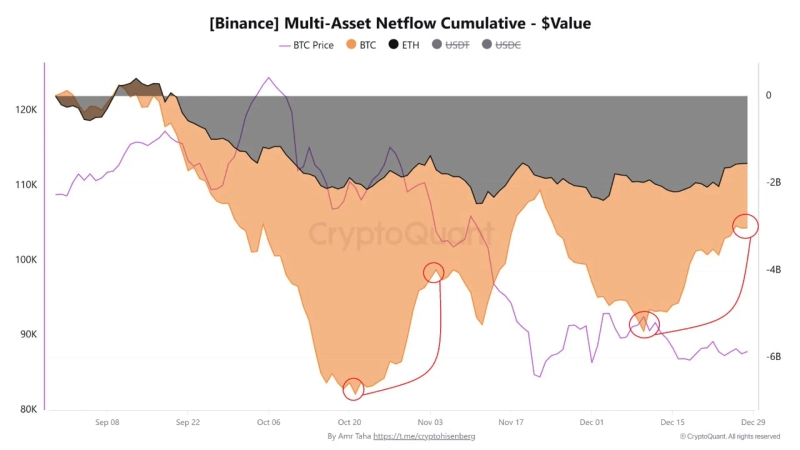

- It reported that Bitcoin's Binance cumulative net inflows surged to about $1.9 billion.

- It stated that during past periods of increased spot exchange deposits of Bitcoin, there were short-term price crashes.

- It said that while this increase in deposits does not mean an immediate decline, caution is needed regarding the possibility of short-term selling pressure.

An analysis found that Bitcoin (BTC) inflows into Binance have rapidly increased again, and supply-demand signals similar to past adjustment phases have been detected.

On the 29th (local time), CryptoQuant contributor Amr Taha said, "Bitcoin's cumulative net inflows into Binance have expanded once again to a meaningful level," and added, "it is necessary to be cautious about the possibility of short-term selling pressure."

According to Taha, the recent size of Bitcoin's cumulative net inflows into Binance increased to about $1.9 billion. This flow formed rapidly in about 17 days from December 10, and this means that Bitcoin is moving from personal wallets or long-term custody addresses to spot exchanges. Generally, such movements are interpreted as actions considering the possibility of selling rather than for holding purposes.

He also pointed out similarities with past cases. The previous time Binance's cumulative net inflows of Bitcoin reached about $1.9 billion was in early November, after about 13 days of inflows following October 21. At that time, Bitcoin's price plunged in a short period from around $108,000 to below $85,000.

Taha explained, "It cannot be concluded that the same price movement will be repeated this time," but added, "historically, periods when large amounts of Bitcoin flow into spot exchanges have repeatedly been observed to see increased selling pressure."

At present, it is difficult to view this increase in deposits as immediately signaling a decline, but from the perspective of short-term supply-demand structure, it can act as a factor that heightens market caution.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Stocks Whipsawed by Iran Crisis… “Money Moves Will Continue” [Weekly Outlook]](https://media.bloomingbit.io/PROD/news/dc1511ef-f8da-4fba-95dc-908afdb380f1.webp?w=250)