Editor's PiCK

[Analysis] Bitcoin briefly recovered $90,000… remains range-bound amid thin year-end liquidity

공유하기

- Bitcoin's price, despite a recent technical rebound, remained range-bound ($86,500–$90,000) throughout December.

- Year-end tax-loss selling and ETF outflows limited the upside, and thin liquidity affected price volatility.

- The market expects a reversal of ETF flows in January, implementation of EU regulation, and changes in U.S. Fed monetary policy could present new opportunities.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Bitcoin (BTC) briefly topped $90,000 ahead of year-end but, analysts say, it failed to decisively break out of the range-bound movement that persisted throughout December.

On the 29th, crypto-focused media outlet The Block reported that Bitcoin rose about 2.8% over the past 24 hours, at one point reaching $90,200. At the same time, Ethereum also rose 2.7% to $3,016. Market participants largely view this rebound as driven more by technical factors than by new fundamental catalysts.

Rick Maeda, a researcher at Presto Research, analyzed, "$90,000 has acted as a clear resistance zone, and short covering and momentum buying appear to have been triggered during the process of reclaiming it."

Vincent Ryu, Chief Investment Officer (CIO) of Chronos Research, expressed a similar view. He explained that Bitcoin rebounded from technical support after a period of consolidation and sideways movement, and key price levels have turned back into support.

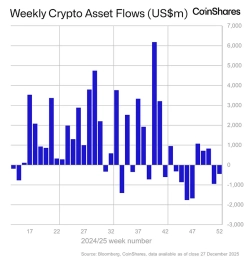

Andri Pauzan Azima, head of research at Bitru, diagnosed that the technical easing flow after options expiry and a recovery in altcoin-led correlations influenced the recent momentum. However, he noted, "Throughout December, Bitcoin generally remained range-bound between $86,500 and $90,000," and analyzed that "tax-loss selling to adjust year-end tax burdens and risk-reduction flows led to ETF outflows of over $1 billion, limiting the upside."

Sentiment indicators showed signs of gradual stabilization. The Fear & Greed Index moved from the 'extreme fear' zone recorded in mid-December to the 'fear' stage. CIO Ryu interpreted this as a sign that market confidence is progressively recovering even in a thin liquidity environment.

Nonetheless, Bitcoin continued to lag relative to traditional financial markets. Last week, while the U.S. stock market rallied and the S&P 500 hit record highs, Bitcoin's price did not respond markedly.

The year-end trading environment was also cited as a factor that amplified volatility. Researcher Maeda explained, "Liquidity thinned as many market participants reduced trading during the holiday period, causing prices to react sensitively even to relatively small inflows." He projected, "Given limited liquidity conditions through early New Year, whether Bitcoin can stably maintain $90,000 on a daily basis will be the key."

Some market participants are re-evaluating Bitcoin's appeal on a relative value basis. Jeff May, Chief Operating Officer (COO) of BTSE, said there is a growing perception that Bitcoin and crypto assets are relatively undervalued compared with major assets such as U.S. stocks, gold, and silver trading near record highs.

Meanwhile, the market is also paying attention to potential new catalysts ahead of 2026. Azima projected that a reversal in ETF flows in January, implementation of EU MiCA regulation, and changes in U.S. Federal Reserve monetary policy, if they coincide, could open a new institution-driven phase.

![[Analysis] Bitcoin briefly recovered $90,000… remains range-bound amid thin year-end liquidity](https://media.bloomingbit.io/PROD/news/fac68f0c-39cb-4793-8eac-de269ba2aefb.webp?w=250)