Gold prices, they said today was the cheapest… '14% plunge' what happened [Analysis+]

공유하기

- It reported that gold and silver prices plunged and volatility widened after the CME increased futures trading margin requirements.

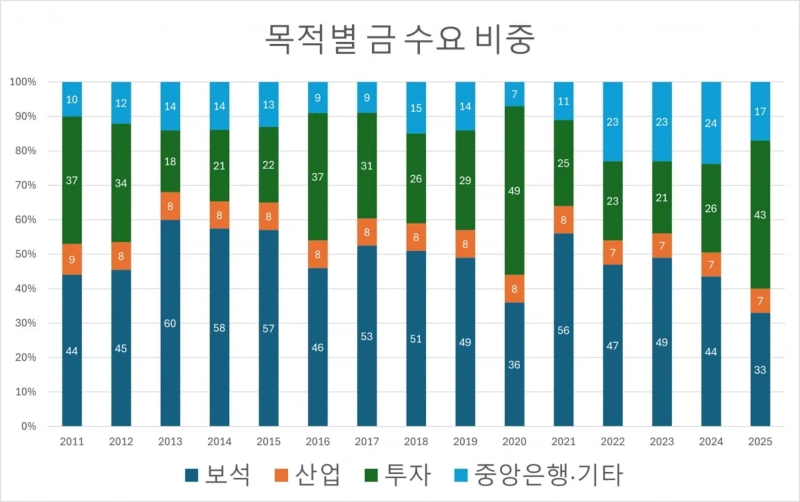

- It noted that investment's share of gold demand this year is 43%, making investors more sensitive to market fluctuations.

- Experts advised that structural supply constraints and strong demand mean the rally is not over, but caution about rising volatility is warranted.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Gold prices hit record highs and plunged due to profit-taking and margin increases

"Investment, which accounts for 43% of this year's gold demand, may slow down"

"Structural supply constraints and strong demand remain… the rally is not over"

Soaring gold and silver prices hit record highs and then plunged. When the Chicago Mercantile Exchange (CME) raised margin requirements for futures trading of major metals, profit-taking selling poured in and volatility widened. Market participants suggested that the upward trend in gold and silver prices might be broken.

According to Investing.com on the 30th, the previous trading day's spot gold price closed at $4332.08 per ounce, a drop of 4.79%. During the session it hit an all-time high of $4550.10 per ounce before plunging sharply. Spot silver also closed at $72.2468 per ounce, 13.98% lower than the record high ($83.9870 per ounce) recorded on the 28th.

The move followed a notice on the 26th that the CME would raise margin requirements from the 29th for futures trading in major metals including gold and silver. When futures margins rise, the cost of maintaining long positions increases.

Investors who bought gold and silver aiming for price differentials are inevitably most sensitive to increases in trading costs. Demand with specific uses, such as industrial raw materials or jewelry, is likely to be relatively less affected by increases in trading costs.

Seo Sang-young, Executive Director at Mirae Asset Securities, citing World Gold Council data, said, "Investment's share of gold demand has often remained in the 20% range in the past, but this year it expanded to 43%," adding, "On that basis, as gold prices surged, investment demand for silver also increased, fueling the sharp rise in silver prices."

With gold and silver prices having risen sharply, the emergence of bad news more likely to affect investors triggered profit-taking selling, the interpretation goes. Although prices plunged the previous day, year-to-date gold prices have risen 65.11% (last year's closing price: $2623.81 per ounce) and silver prices have risen 150.22% (last year's closing price: $28.8738 per ounce).

Opinions differ on whether gold and silver prices will shift into a downtrend.

Rishabh Amin, Multi-Asset Portfolio Manager at Allspring Global Investments, told the Financial Times (FT) that "this situation corresponds to entering a very strong correction phase rather than a short-term plunge following speculative overheating."

On the other hand, Jeff Kilburg, CEO and CIO of KKM Financial, called the recent plunge in gold and silver prices a "historic move," but added, "This correction is a temporary pause at year-end; given structural constraints on the supply side and strong demand, it is hard to say the rally is over."

Among precious metals, gold's trend has been driven by currency values and economic growth. When the value of the anchor currency, the U.S. dollar, rises, or when industrial growth reduces gold's appeal because it does not generate added value, gold prices fall. The period when former Fed Chair Paul Volcker raised the policy rate to 18% in the 1980s and the late 1990s during the dot-com boom, when the stock market was strong, are typical examples of gold price declines.

Market analysts say that if the U.S. Fed does not pursue as accommodative a policy as markets expect next year, or if the AI industry escapes bubble concerns and grows more steeply than expected, gold prices could be pressured.

Seo Sang-young's advice to pay attention to increasing volatility rather than the direction of precious metals prices is also noteworthy. He said, "The CME's margin hike acts to curb leveraged use by speculative funds," adding, "As supply and demand are adjusted in the process, volatility is likely to increase whether prices rise or fall."

Han Kyung-woo, Hankyung.com reporter case@hankyung.com

![[Analysis] "Bitcoin long-term holders switch to net buying for the first time since July…signal of easing selling pressure"](https://media.bloomingbit.io/PROD/news/3bfc495e-f0af-4fcd-829a-8dac124bda3c.webp?w=250)

![[2026 Bitcoin Outlook] Industry divided..."ETF drives rebound" vs "Long correction coming"](https://media.bloomingbit.io/PROD/news/9aa40a7c-661c-4142-a79d-1aad7f176a5a.webp?w=250)

![[Analysis] "Bitcoin long-term holders' selling pressure eases… Ethereum whales continue accumulating"](https://media.bloomingbit.io/PROD/news/aef401c1-8d8b-44ff-9d73-95669fae5bf8.webp?w=250)