Editor's PiCK

Crypto exchange governance 'major overhaul'…likely to affect Naver and Mirae Asset's entry

공유하기

- Reported that the government is pushing a plan to limit major shareholders' stakes in virtual asset exchanges to 15~20%%.

- Said that the largest shareholders of the five major domestic exchanges will face share reductions, and that Naver and Mirae Asset's acquisition plans are also expected to encounter setbacks.

- Noted that upon enactment, exchanges will switch to a licensing system, making major shareholder suitability and ownership dispersion requirements important.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Government pushing to limit major shareholder stakes…first domestic exchange established 13 years ago

Switching from a notification system to a licensing system

Public interest likely to be greatly strengthened

Principle of separating finance and virtual assets effectively relaxed

Encouraging participation of existing financial firms

Direct hit to Dunamu, Bithumb, etc.

Will also affect exchange M&A

The government is pushing a plan to limit the stake of major shareholders in domestic virtual asset exchanges, whose trading volume exceeds 1,000 trillion won. This marks a full overhaul of governance 13 years after the first virtual asset exchange was established domestically. With up to 11 million users on exchanges, the aim is to strengthen public interest through "ownership dispersion." With all five major domestic exchanges in scope, it is expected to become a variable in the big deals pursued by Naver and Mirae Asset to acquire Dunamu and Korbit, respectively.

Cap major shareholder stake at up to 20%

According to the industry on the 31st, the Financial Services Commission is strongly considering a proposal in the Digital Asset Basic Act to limit major shareholders' stakes in virtual asset exchanges to 15~20%. The plan is to redefine virtual asset exchanges as public infrastructure equivalent to alternative trading systems (ATS). Under the current Capital Markets Act, an ATS may not own more than 15% of voting shares, including those held by special related parties. Financial institutions and public funds may exceptionally hold more than 15% only if approved by the Financial Services Commission. NextTrade, for example, is divided among seven securities firms including Korea Investment and Mirae Asset, each holding 6.64%.

The government's effort to revise the governance of virtual asset exchanges is analyzed as an intention to correct the current structure in which a small number of founders or shareholders exercise excessive influence over overall exchange operations. The plan also aims to break the duopoly by the top two platforms, Upbit and Bithumb, and create an ecosystem where a variety of operators can enter and compete fairly.

A key measure being discussed is switching the current notification system to a licensing system. Until now, authorities have relied on indirect management and control through banks providing real-name accounts without direct licensing or governance reviews by the financial regulator. If the law is enacted, exchanges will likely need business licenses from the financial regulator to operate. In that process, major shareholder suitability reviews and ownership dispersion requirements are expected to serve as key criteria.

The principle that has limited the combination of traditional finance and virtual asset businesses—the 'separation between finance and virtual assets'—is likely to be relaxed. Without participation from regulated financial institutions in the ownership dispersion process, it would be difficult to ensure market stability and effective supervision. If combined with industrial promotion measures expected to be included in the bill, the domestic digital asset market, which is currently centered on individual trading, could be advanced into areas such as institutional investment, real-world asset tokenization (RWA), and security tokens (STO). A source in the financial sector said, "Exchanges are large in scale, but their governance and user protection systems are still at a child's level," adding, "Fundamental change is needed."

Share reductions appear inevitable

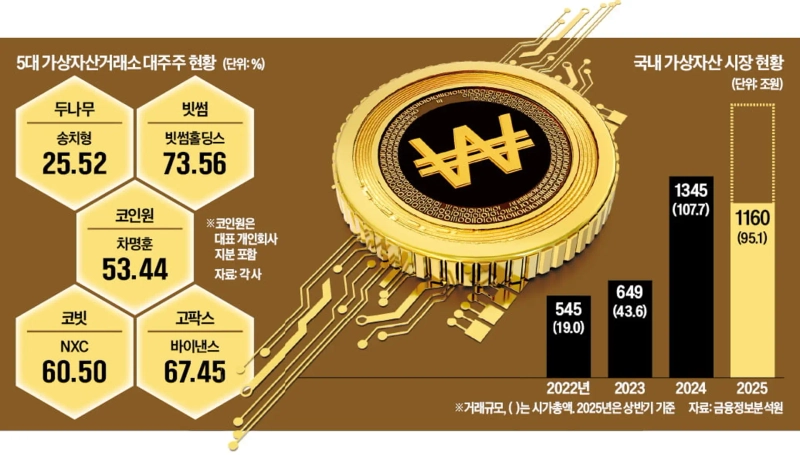

To continue operations after the law takes effect, the largest shareholders of the five domestic won-denominated virtual asset exchanges will have to sell shares. Dunamu, which operates Upbit, has Chairman Song Chi-hyung as the largest shareholder with a 25.52% stake. Bithumb is 73.56% owned by Bithumb Holdings. Coinone's founder, CEO Cha Myung-hoon, holds 53.44% including shares held through a personal company, and Korbit is 60.5% owned by NXC. In Gopax's case, the overseas exchange Binance holds 67.45%. Besides the largest shareholders, major shareholders owning more than 20% exist across exchanges. Their stake reductions are unavoidable.

For this reason, it is observed that the plans of Naver and Mirae Asset to incorporate Dunamu and Korbit, respectively, could face setbacks. Naver announced it would incorporate Dunamu as a grandchild company through a share swap between its affiliate Naver Pay and Dunamu. Because Naver Pay would hold 100% of Dunamu's shares in that structure, it would be subject to the major shareholder stake limit. Accordingly, a redesign of the ownership structure is highly likely.

The same applies to Mirae Asset, which plans to acquire Korbit. Mirae Asset signed a memorandum of understanding (MOU) to acquire shares from Korbit's largest shareholder NXC and the second-largest shareholder SK Planet (31.5%). However, if the related regulation materializes, significant constraints are expected for Mirae Asset to acquire Korbit's management rights. A source in the financial sector said, "A sufficient grace period may be provided during the transition to a licensing system," adding, "Share adjustments are likely to proceed gradually accordingly."

Mihyeon Jo / Hyunggyo Seo reporters mwise@hankyung.com

![D'CENT Grew 200%, Evolves into an 'All-in-One Investment Wallet'… Accelerates Expansion into Institutional and Corporate Markets [Coin Interview]](https://media.bloomingbit.io/PROD/news/606e1fd0-0619-4c39-a7d9-ecab11a3d843.webp?w=250)