PiCK

A virtual asset market that stopped laughing… Could a 'reversal' be possible in 2026?

Summary

- Experts forecast that in 2026 demand in the virtual asset market will increase centered on Bitcoin and Ethereum.

- They analyzed that with expanded real-world use cases such as RWA, prediction markets, and artificial intelligence (AI), virtual assets are likely to prove their real investment value beyond being speculative assets.

- On the other hand, warnings were issued that XRP and ADA may be left behind in the market due to a lack of real-world use cases.

2026 Virtual Asset Industry Outlook

Virtual assets: Expectations for expanded real-world use ↑

"Demand to increase centered on Bitcoin and Ethereum"

"XRP and ADA may be left behind" warning

The 2025 virtual asset market saw a stark contrast between the mood in the first and second halves. In the first half of this year, with the inauguration of U.S. President Donald Trump in January, major coins hit record highs and digital asset treasury (DAT) firms emerged one after another, producing an unprecedented boom. In contrast, in the second half, macroeconomic uncertainty weighed on the market, and investor sentiment did not escape a mood of 'fear' even up to December 31, the last day of the year.

Experts agreed that virtual assets are likely to go through a 'time of proof' next year. If virtual assets attracted attention as investment targets this year, next year is expected to enter a phase in which virtual assets and blockchain technology combine with actual industries to demonstrate real-world utility.

Prediction markets, AI, RWA… will drive real-world use

Currently, the areas receiving the most attention in the industry are decentralized prediction markets, artificial intelligence (AI), and real-world assets (RWA). These areas are considered sectors where virtual assets can create real use cases beyond being speculative assets.

Prediction markets drew attention during the last U.S. presidential election when Polymarket and Kalshi correctly predicted President Trump's victory. Thanks to the rapid growth of the prediction market industry this year, Polymarket and Kalshi were recently valued at $9 billion and $11 billion, respectively. Major virtual asset companies such as Coinbase and Gemini also announced entry into prediction markets one after another this year.

Experts expect that prediction markets will go beyond simple betting platforms next year. Jay Yu, a partner at Pantera Digital, said via X, "Prediction markets will achieve financial and cultural development," and "while integrating with decentralized finance (DeFi), they may become a hobby for some investors."

There is also a view that integration with the media will accelerate. Polymarket recently partnered with Yahoo Finance, and Kalshi partnered with CNN and CNBC. Domestic web3 research firm Tiger Research analyzed, "Media outlets that feel limited in diversifying revenue models are likely to introduce prediction markets to seek new breakthroughs," adding, "A structure could be created in which readers do not merely consume news but directly participate in the outcomes of news."

Services that combine AI and virtual assets also have a bright outlook. In 2025, a number of AI-related virtual assets emerged. Notable examples include Virtual Protocol (VIRTUAL), Sahara AI (SAHARA), Newton Protocol (NEWT), Kite (KITE), and ZeroG (0g). From next year, attention will focus on whether such AI-based virtual asset projects can move beyond experimental stages to produce concrete real-world use cases.

Global web3 venture capital firm Hashed recently stated in a report that on-chain payments using AI could become widespread. Kim Seo-jun, CEO of Hashed, said, "Stablecoins have established themselves as a global payment method this year," and "In the future, AI could emerge as an entity that performs transactions, settlement, and execution using stablecoins on behalf of investors or companies."

Blockchain projects that can address the AI industry's concentration in a few large corporations are also a promising area. U.S. asset manager Grayscale said, "The centralization of the AI industry is creating issues such as trust, bias, and ownership," and "decentralized AI that can be developed through blockchain-based infrastructure could be a solution."

RWA is considered a field that will lead the real-world utilization of virtual assets. RWA refers to the sector that tokenizes real assets such as government bonds, real estate, commodities, and receivables on blockchain for trading and settlement. The RWA industry, including tokenized government bonds and stocks, has already seen significant growth this year. Tokenized U.S. Treasury securities recently exceeded $8.67 billion, up from $3.873 billion at the beginning of the year, an increase of about 125%.

Experts view RWA as serving as a bridge between traditional finance and virtual assets. Hashed said, "Major countries are already trying to incorporate RWA into the institutional framework in their own ways," adding, "RWA will allow virtual assets to play a role in the real economy beyond the perception of being speculative assets."

What is the outlook for major coins?

Bitcoin and Ethereum 'smile'… XRP and ADA 'bitter words'

The outlook for Bitcoin remains positive in 2026. Grayscale noted, "High U.S. national debt and inflation risks are widespread, and macroeconomic instability persists," and said, "In such uncertainty, Bitcoin will attract more institutional demand as a means of portfolio diversification and risk dispersion." It also stated, "The four-year cycle theory of Bitcoin is no longer valid," and forecasted, "(Bitcoin) could hit a new record high in the first half of next year."

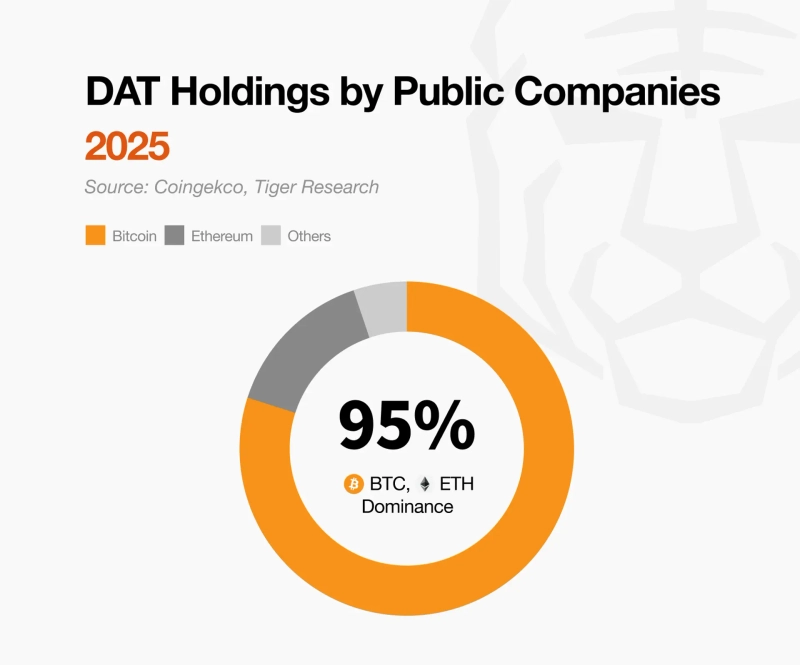

Tiger Research analyzed, "(This year) the virtual asset market has been reorganized around institutions, and capital flows have become somewhat more conservative," adding, "Since institutions avoid unproven assets, it may be difficult to expect the trickle-down effect where funds flow into the altcoin market after Bitcoin's price rises as in the past."

Ethereum, considered the leading altcoin, also has a positive outlook for next year. The view is that if real-world use of virtual assets becomes full-fledged through RWA and prediction markets, the Ethereum blockchain could establish itself as a major infrastructure. Grayscale predicted, "Demand for Ethereum will also increase as companies' use of blockchain-based payments and smart contracts grows."

XRP and ADA may face difficulties from the new year. This is because they still lack real-world use cases compared to other virtual assets. Mike Novogratz, CEO of Galaxy Digital, said, "XRP and ADA now need to demonstrate practical utility," adding, "A structure that relies only on community loyalty is likely to fall behind as competition in the virtual asset industry intensifies."

Jinwook, BloomingBit reporter wook9629@bloomingbit.io

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![Bitcoin retakes KRW 100 million amid reports of secret US-Iran contacts…$72,000 in focus [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/3beef0db-a8f6-4977-9dca-6130bf788a69.webp?w=250)

![[Analysis] “ETFs and short covering drove Bitcoin’s rebound…on-chain indicators are mixed”](https://media.bloomingbit.io/PROD/news/6c7dbd31-4aeb-400e-9c43-c2843062fc66.webp?w=250)