[Analysis] "Bitcoin ETF concentration and fund volatility, the liquidity conditions that define the box range"

Summary

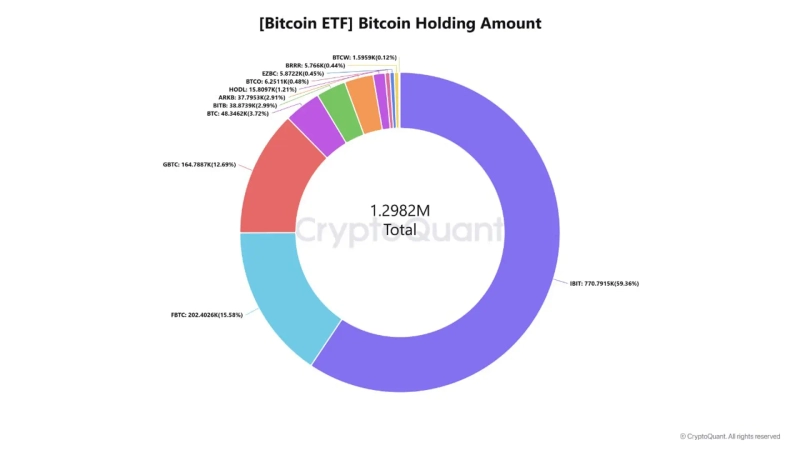

- Demand for spot Bitcoin ETFs reached an all-time high, but it reported that funds are concentrated in a few ETFs, making prices vulnerable to volatility.

- Although volatility in ETF fund flows has increased recently, it said prices are more closely linked to the global liquidity environment than to inflows into individual ETFs.

- With institutional funds mainly concentrated in Bitcoin ETFs, it assessed that future price direction depends on the sustainable inflow of funds and global liquidity expansion.

Demand through spot Bitcoin (BTC) exchange-traded funds (ETFs) has expanded to an all-time high, but short-term price movement remains in a box range, and analysts say this is due to structural constraints of ETF fund 'concentration' and 'liquidity volatility'.

On the 6th (local time), CryptoQuant contributor CryptoZeno wrote, "The amount currently held by spot Bitcoin ETFs reaches about 1.3 million BTC, but the distribution is extremely concentrated. BlackRock's IBIT accounts for about 59% of the total, followed by Fidelity's FBTC (about 15.6%) and Grayscale's GBTC (about 12.7%)."

This means spot ETF demand is driven not by many issuers but by a few core products. As a result, analysts say there is an inherent vulnerability where inflow/outflow changes in a specific ETF can have an excessive price impact on the entire market.

He added, "This characteristic is clearly visible in recent US spot Bitcoin ETF fund flows: after large net inflows occur, aggressive net outflows follow, increasing volatility," and analyzed, "However, price reactions have changed compared to the past. Sensitivity to temporary large inflows into individual ETFs has decreased, while the pattern of being more closely linked to the global liquidity environment and fund flows across risk assets has strengthened." In fact, in phases of tightened liquidity, there have been repeated cases where ETFs record net inflows but prices move sideways or adjust rather than rise.

Bitcoin's standing is also confirmed in relative flows between assets. Over the past 30 days, the net inflow gap between Bitcoin ETFs and Ethereum ETFs remains large. Institutional funds are mostly concentrated in Bitcoin, while Ethereum ETF funds see intermittent inflows and lack persistence. This allocation leads to weakness in the ETH/BTC ratio, suggesting that a full rotation of funds into Ethereum has not yet occurred.

CryptoZeno assessed, "It is a clear change that the circulating supply of Bitcoin has structurally decreased due to the introduction of ETFs. However, short-term price direction is now determined not by the mere size of ETF inflows but by how 'sustainably' funds flow in and whether those flows coincide with global liquidity expansion."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Stocks Whipsawed by Iran Crisis… “Money Moves Will Continue” [Weekly Outlook]](https://media.bloomingbit.io/PROD/news/dc1511ef-f8da-4fba-95dc-908afdb380f1.webp?w=250)