PiCK

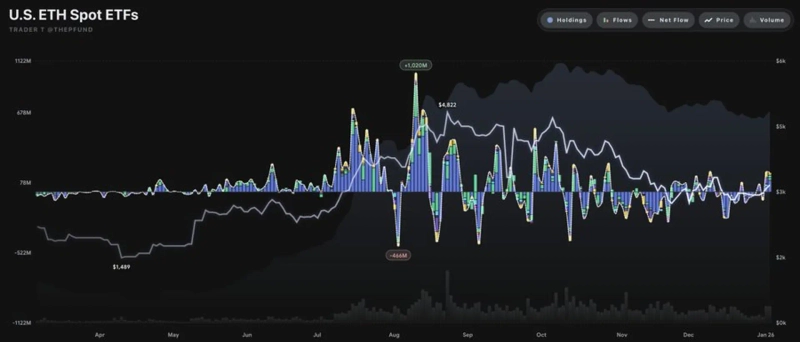

U.S. Ethereum spot ETF, $165.45 million inflow the previous day… signs of institutional funds returning

Summary

- Reported that U.S. Ethereum (ETH) spot ETF saw large inflows of $165.45 million.

- Signs of institutional demand recovery were observed, and funds concentrated in products from large asset managers such as BlackRock, Fidelity, and Bitwise ()large asset manager products().

- Some funds also flowed into Grayscale-affiliated products, but the remaining products had no net inflows or outflows.

Large inflows were observed into U.S. Ethereum (ETH) spot exchange-traded funds (ETFs), signaling a recovery in institutional demand early in the year.

On the 6th (local time), according to Trader T, the total net inflow for Ethereum ETFs the previous day was $165.45 million (approximately 238.8 billion won). This marked net inflows for two consecutive trading days.

Inflows were concentrated in products from large asset managers. BlackRock's ETHA received $100.23 million, accounting for the largest share. Fidelity's FETH also received $21.83 million, and Bitwise's ETHW recorded a net inflow of $19.73 million.

Some funds also flowed into Grayscale-affiliated products. Grayscale's ETHE saw a net inflow of $1.32 million, and Mini Trust ETH had a net inflow of $22.34 million. The remaining products had no net inflows or outflows.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Oil prices surge and jobs shock extend selloff for a second day…Nasdaq slides 1.6% [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/dffd88df-c1d6-44e9-a14e-255794d5ae09.webp?w=250)