Surpassed NVIDIA's market cap…"Could be three times higher than now" stunning forecast

공유하기

Summary

- Silver's market value reportedly surpassed global stock market leader NVIDIA, ranking as the second-largest single investment asset.

- Silver prices have continued a sharp rise due to global instability and China's export restrictions.

- Some investment banks (IBs) forecast that silver prices could rise more than threefold from current levels.

The advance of Silver… Surpassed NVIDIA's market cap

Investment flows amid global instability

Market cap 4.6 trillion dollars… 2nd largest single investment asset

IBs: "Silver price could be three times higher than now"

Silver's market value has apparently even overtaken the global stock market leader NVIDIA. Silver prices have continued their sharp rise as various factors—global instability, inflation concerns, and China's export restrictions—have coincided.

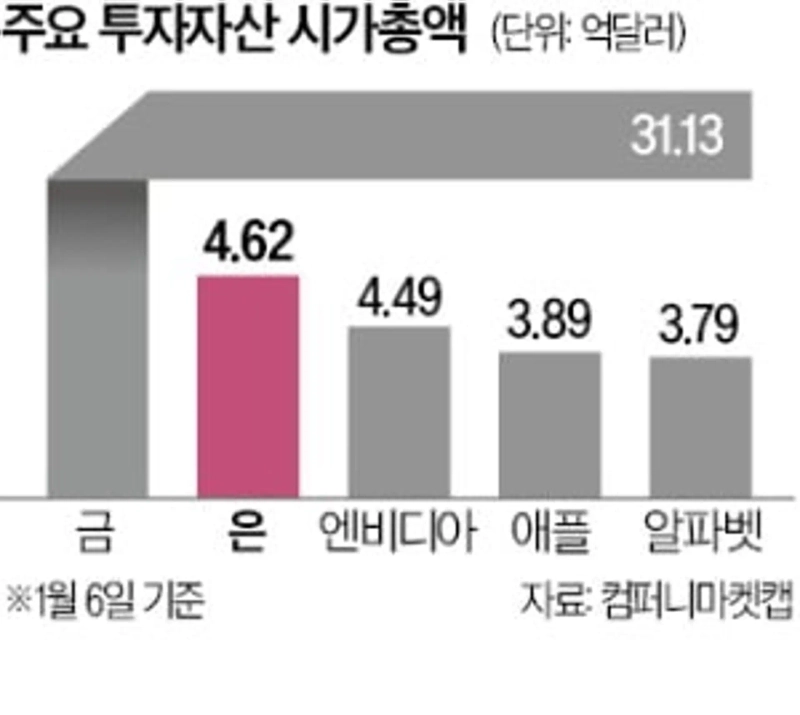

On the 6th (local time), according to U.S. financial information firm CompanyMarketCap, silver's market value totaled 4.627 trillion dollars (about 6,700 trillion won), surpassing NVIDIA's market cap (4.55 trillion dollars). This figure was calculated based on the estimated circulating silver amount (1.75 million t) and the New York Mercantile Exchange trading price of 81.04 dollars per troy ounce. This is the first time silver's estimated market value has exceeded NVIDIA's market cap.

By single investment asset, the asset with the largest market value is gold. Its estimated market cap reaches 31.135 trillion dollars. Leading virtual asset Bitcoin ranks eighth, following Apple, Alphabet (Google's parent company), Microsoft, and Amazon.

Spot silver prices have risen 165.91% since last year. There is virtually no comparison among major commodities. Analysts say that when China, the largest demand center and the second-largest producer, switched silver exports to a permit system, speculative buying even emerged. The U.S.'s ousting of Nicolas Maduro's Venezuelan regime, which increased international instability, is also evaluated to have contributed to the precious metals rally that includes silver.

Some investment banks (IBs) see room for silver prices to rise more than threefold from current levels. Michael Widmer, a Bank of America analyst, said, "Current silver prices are trading at about one-sixtieth the level of gold, which is not high compared to past cases," and "Considering that silver rose to the one-fourteenth level in the 1980s, a price in the $300-per-troy-ounce range is possible."

Beomjin Jeon reporter forward@hankyung.com

![[Analysis] "Ethereum institutional demand weakens… limited upside for a break above $3,300"](https://media.bloomingbit.io/PROD/news/32e4b2a7-4f84-485c-b9e1-4aff41b29a65.webp?w=250)

![[Analysis] "Bitcoin ETF inflows stabilizing…Institutional investors are returning"](https://media.bloomingbit.io/PROD/news/b354b5ba-6050-49d5-a9c1-15394f2a5ee3.webp?w=250)