[Analysis] "Bitcoin weakness signals a sharp correction, not a structural breakdown"

Summary

- PelinayPA said Bitcoin weakness is closer to a sharp correction within a bullish trend than a long-term structural breakdown.

- He noted that the Puell Multiple, NUPL, and MVRV are at levels different from prior cycle peaks, indicating the market is far from overheating.

- He added that shifts in supply-constraint dynamics and institutional inflows via spot ETFs are changing the characteristics of the traditional Bitcoin cycle.

Forecast Trend Report by Period

An analysis suggests that the current weak phase in Bitcoin (BTC) is closer to a sharp correction within an ongoing uptrend than to a long-term structural breakdown.

On the 12th (local time), PelinayPA, a contributor to the on-chain data analytics firm CryptoQuant, said, "Bitcoin’s recent weakness is closer to a sharp correction within a bullish trend than to a long-term structural breakdown. Key on-chain indicators are showing a different pattern from prior cycle peaks."

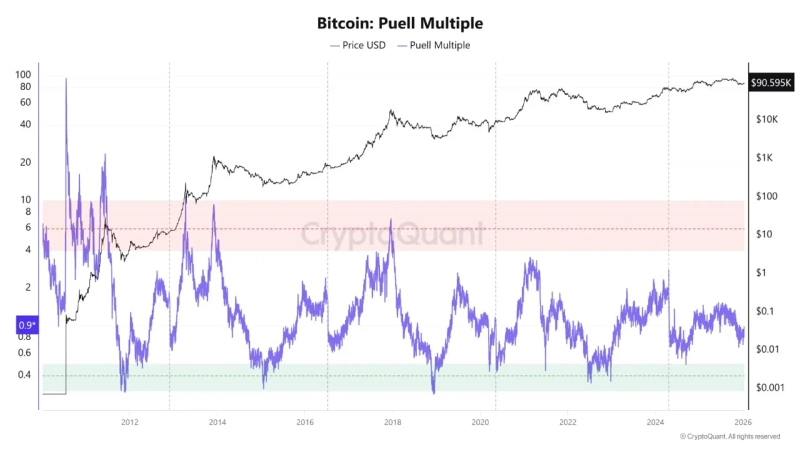

PelinayPA pointed to the Puell Multiple, a gauge of miner profitability, noting it is currently hovering around 0.9. This is not an extreme zone that has historically signaled tops or bottoms, and with miner profitability low, miner-driven selling pressure is also limited, the analysis said. As for why the Puell Multiple is not rising alongside prices despite elevated price levels, PelinayPA cited a structural easing of supply pressure as block rewards declined after the halving.

Net Unrealized Profit/Loss (NUPL), which reflects investor sentiment, is also far from signaling overheating. NUPL currently stands at around 0.37, suggesting that while market participants are broadly in profit, the market has not entered a euphoric phase. PelinayPA said, "This range has been repeatedly observed in the mid-stages of past bull markets and is similar to periods when relatively deep pullbacks emerged within an upward trend." The Market Value to Realized Value (MVRV) ratio is also only around 1.6, markedly below the 3.0-plus zone where prior cycle tops were formed.

Taken together, these indicators suggest that any further Bitcoin downturn is more likely to resemble a sharp correction within a broader macro bullish backdrop than a prolonged, structural breakdown like those seen in the past. PelinayPA added, "Unlike the 2017–2021 cycle, in this cycle prices have risen first, yet major on-chain indicators are not confirming the move," and said this "suggests that changes in supply-constraint dynamics and the inflow of institutional demand via spot ETFs are altering the characteristics of the traditional Bitcoin cycle."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Stocks Whipsawed by Iran Crisis… “Money Moves Will Continue” [Weekly Outlook]](https://media.bloomingbit.io/PROD/news/dc1511ef-f8da-4fba-95dc-908afdb380f1.webp?w=250)