Standard Chartered: “2026 will be the year of Ethereum…relative outperformance expected”

공유하기

Summary

- Standard Chartered said Ethereum is likely to deliver relative outperformance versus Bitcoin in 2026.

- Standard Chartered lowered Ethereum’s near-term price targets but presented a long-term target that could rise to $40,000 by end-2030.

- Standard Chartered said Ethereum’s position in stablecoins, RWA, and DeFi, along with a potential reversion of ETH/BTC to 0.08, underpins its relative strength case.

Global bank Standard Chartered has designated 2026 as the year of Ethereum (ETH), forecasting that ETH will deliver relative outperformance versus Bitcoin. While it trimmed its near-term price outlook somewhat, it maintained medium- to long-term upside potential on the back of improving structural fundamentals.

According to crypto (digital-asset) news outlet The Block on the 12th, Geoffrey Kendrick, head of digital assets research at Standard Chartered, said in his latest report that “2026, like 2021, will be the year of Ethereum,” adding that “as blockchain and on-chain product adoption expands, Ethereum will meaningfully outperform the market.”

Standard Chartered did, however, revise its short-term price targets. It lowered its end-2026 target for Ethereum to $7,500 from $12,000, and cut its 2027 and 2028 forecasts to $15,000 and $22,000, respectively. By contrast, it raised its long-term outlook, presenting new targets of $30,000 by end-2029 and $40,000 by end-2030.

The bank said Bitcoin’s underwhelming performance has been capping US dollar-denominated returns across the digital-asset complex, but argued that, in relative terms, Ethereum’s momentum is strengthening. As key support, it pointed to Ethereum’s entrenched position in stablecoins, real-world asset tokenization (RWA), and decentralized finance (DeFi).

Standard Chartered projected that the Ethereum-to-Bitcoin price ratio (ETH/BTC) could gradually revert toward around 0.08, the peak level seen in 2021. This reflects its view that Ethereum has a structural edge in network scalability and on-chain utilization.

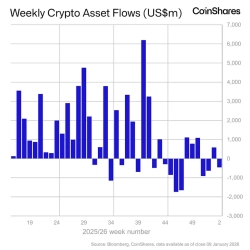

Flows are also seen as relatively resilient for Ethereum. The report noted that momentum has broadly cooled for listed digital-asset exchange-traded products and corporate treasury allocations, but Ethereum has shown comparatively stronger support than Bitcoin. It highlighted that Bitmine Immersion, which has adopted an Ethereum-focused corporate treasury strategy, holds about 3.4% of the circulating supply and plans to expand that to 5% over the medium to long term.

An upbeat outlook for the stablecoin and tokenized real-world asset markets was also maintained. Standard Chartered estimates both markets could reach $2 trillion each by 2028, and said that more than half is already operating on the Ethereum network.

Network metrics were also assessed positively. Ethereum transaction counts have recently hit record highs, with 35–40% of those coming from stablecoin transactions. Plans to expand Layer 1 throughput, including the Fusaka upgrade implemented last December, were cited as a key variable for medium- to long-term market-cap gains.

In addition, Standard Chartered flagged potential improvements in the US regulatory environment as a swing factor. The bank said that if the Clarity bill currently under discussion in the US Congress passes in the first quarter, Bitcoin could set a new all-time high in the first half alongside equities—an outcome that could also support Ethereum’s long-term upside scenario.