U.S. Senate Democrats call for a hearing ahead of crypto bill markup, citing concerns over a rushed process

Summary

- Democratic senators have raised procedural concerns over the U.S. Senate Banking Committee’s digital-asset (cryptocurrency) market structure bill, calling for a formal hearing.

- Democrats described the bill—expected to exceed 200 pages—as the most consequential legislation the committee will consider this century, arguing that sufficient time is needed for review.

- Markets see limited odds that the letter will upend the markup schedule itself, but say it highlights renewed bipartisan tensions in the bill’s passage.

Forecast Trend Report by Period

Democratic senators have raised procedural concerns over the U.S. Senate Banking Committee’s digital-asset (cryptocurrency) market structure bill, calling for a formal hearing.

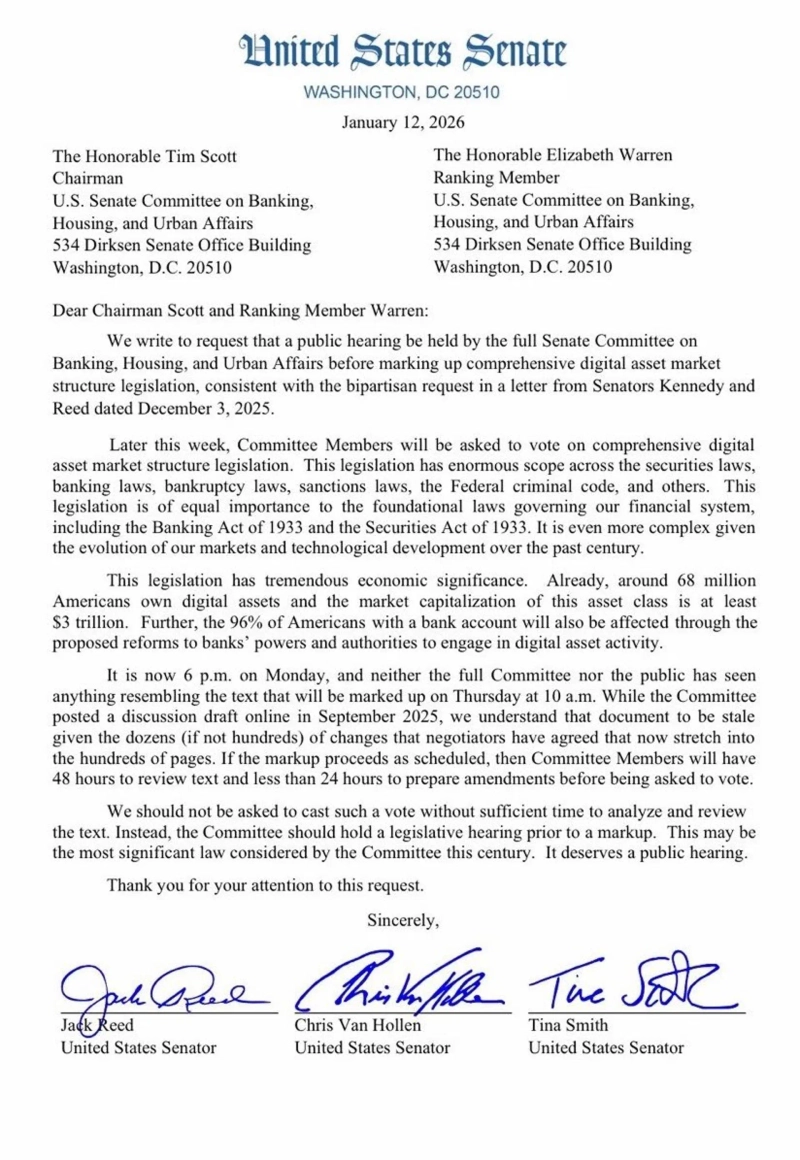

According to Eleanor Terrett, host of CryptoAmerica, on the 13th (local time) Senators Chris Van Hollen, Tina Smith and Jack Reed sent a letter to the Senate Banking Committee’s Republican leadership two days ahead of the markup, opposing the plan to push ahead with a vote without a formal hearing.

In the letter, the senators said it was inappropriate for bill text—expected to run well over 200 pages—to be released just two days before the markup. They described it as “the most consequential bill the committee will consider this century” and argued that more time is needed for thorough review.

However, the three senators have previously taken a critical stance toward digital assets, fueling expectations that they are likely to vote against the legislation regardless of whether a hearing is held. Some in the market also interpret the move as focused more on questioning the legitimacy of the legislative process than on the substance of the bill.

Earlier, just before the Christmas recess, Republican Senator John Kennedy sent a letter with Senator Jack Reed making a similar point—that a hearing is needed to understand the issues. Kennedy did not join the latest letter, and it remains unclear whether he still holds the same view.

Market participants say the letter is unlikely to significantly disrupt the markup schedule itself, but are watching as it underscores renewed partisan tensions in the bill’s legislative process.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Oil prices surge and jobs shock extend selloff for a second day…Nasdaq slides 1.6% [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/dffd88df-c1d6-44e9-a14e-255794d5ae09.webp?w=250)