[Analysis] "Bitcoin’s stagnation below $100,000 is a warning sign… could return to $10,000 this year"

Summary

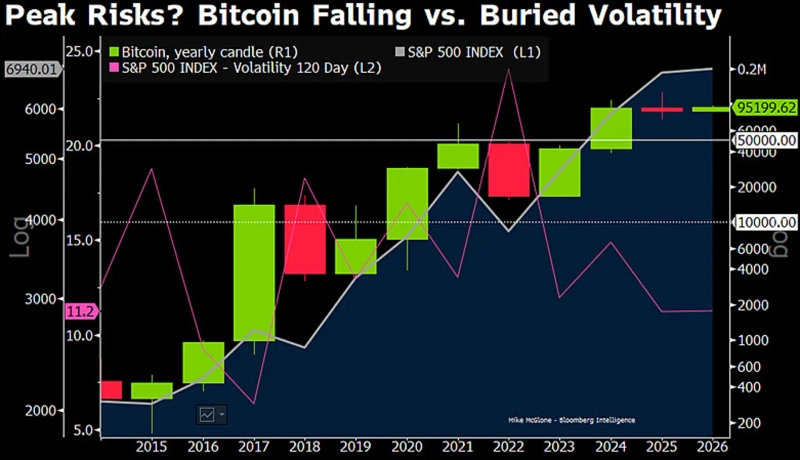

- Mike McGlone said that if Bitcoin fails to break above $100,000, it could signal the cycle’s end-game and a possible return to $10,000.

- He viewed the move below the 200-day moving average and the early-2026 rebound not as a bullish recovery but as a prove-strength phase, adding that a $50,000 correction this year would be a typical pullback.

- McGlone said further gains in Bitcoin require an equity-market recovery, and that metals (precious metals) could form a relative peak this year rather than crypto assets.

Forecast Trend Report by Period

Bitcoin has rebounded after forming a peak in 2025, but a warning has emerged that it could enter a large-scale correction phase over the medium to long term.

On the 19th (local time), Mike McGlone, a strategist at Bloomberg Intelligence, raised the prospect of medium- to long-term downside for Bitcoin (BTC), saying, “A failed advance in 2025 could imply a cautious short (downside bet) scenario in 2026.” He noted that while Bitcoin slipped below its 200-day moving average and then rebounded in early 2026, he interprets this not as a “bullish recovery” but as a “prove-strength” phase.

McGlone said that Bitcoin has led the broad liquidity rally in risk assets since its launch in 2009, but its inability to break above and hold beyond $100,000 could signal the cycle’s end-game. He added, “If normal mean reversion follows an excessive run-up, a return to the $10,000 level cannot be ruled out.”

He particularly stressed that Bitcoin’s risk-adjusted returns have been weak since 2021. Taken together—hype, an effectively unconstrained crypto supply structure, and annual chart patterns—a correction to around $50,000 within this year would be a typical pullback often seen in “overextended assets,” he said.

McGlone argued that further gains in Bitcoin would require a recovery in the equity market. “Bitcoin and gold have delivered meaningful alpha over the past decade or so, but crypto surged excessively last year,” he said, adding that “metals (precious metals) could instead form a relative peak this year.” Depending on how things unfold, Bitcoin and other crypto assets could face downward pressure.

He concluded by suggesting that in a “post-inflation” phase, Bitcoin could serve as a leading indicator for gauging deflationary trends. Some interpret this as indicating that Bitcoin is no longer merely a risk asset, but is shifting into an asset that responds sensitively to changes in the macro environment.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Oil prices surge and jobs shock extend selloff for a second day…Nasdaq slides 1.6% [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/dffd88df-c1d6-44e9-a14e-255794d5ae09.webp?w=250)