"XRP derivatives market sees large-scale long liquidations…leveraged positions adjusted amid macro jitters"

공유하기

Summary

- It said the XRP (XRP) derivatives market saw large-scale forced liquidation of long positions, sharply amplifying short-term volatility.

- It reported that selling pressure spread across the broader crypto market after reports that major European countries were considering tariffs against the US and restrictions on US companies’ access to the EU market, leading to weakness in altcoins and a wholesale unwinding of XRP long positions.

- It stressed that XRP long liquidations exceeded $5 million in a day, one of the largest this month, and that in a phase of rising macro uncertainty, leveraged positions are hit first—making it hard to rule out the possibility of additional short-term volatility.

An analysis says the XRP derivatives market saw forced liquidation of large long positions, sharply amplifying short-term volatility.

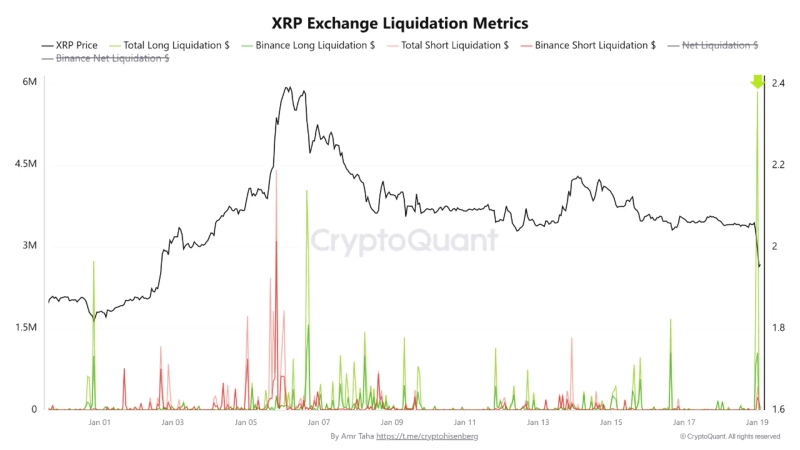

On the 19th, analyst Ama Taha said in a CryptoQuant QuickTake report that “the 18th was a brutal day for XRP derivatives traders,” adding that “large-scale forced liquidations occurred across exchanges, concentrated in long positions.”

The liquidations are seen as the result of a macro shock rather than an idiosyncratic single-asset issue. On the 18th, reports said major European countries could consider tariffs against the US or restricting US companies’ access to the EU market in response to pressure from President Trump over the Greenland issue, spreading selling pressure across the broader crypto market. Bitcoin (BTC) quickly turned lower, and altcoins (cryptocurrencies other than Bitcoin) also weakened in tandem, prompting a wholesale unwinding of long positions that had crowded into the XRP derivatives market.

According to the report, XRP long liquidations exceeded $5 million over the course of the 18th alone. It is seen as one of the biggest single-day liquidation events so far this month. Of that, long liquidations on Binance alone totaled about $1.05 million (about 15.5 billion won). The analyst said it was “not an issue confined to a specific exchange, but a case where a broad leverage buildup was unwound simultaneously.”

The analyst stressed that “when macro uncertainty rises, leveraged positions are the first to be sacrificed,” adding that “this XRP long liquidation shows the market remains highly sensitive to political and trade issues.” He added that “if a similar environment repeats, it is hard to rule out the possibility of further volatility expansion in the short term.”