US spot Ethereum ETFs post $283.46 million in net outflows…selling pressure intensifies

공유하기

Summary

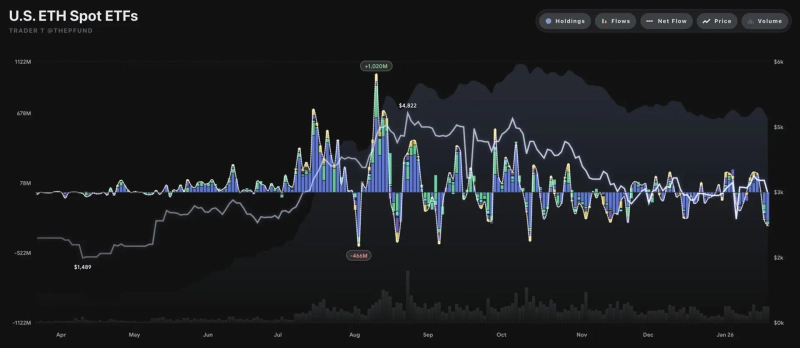

- US spot Ethereum ETFs saw $283.46 million in net outflows in a single day, further dampening investor sentiment.

- BlackRock’s ETHA posted $246.78 million in outflows and Fidelity’s FETH saw $30.89 million leave, concentrating selling pressure among large asset managers.

- The market says Bitcoin ETF withdrawals and rising Ethereum price volatility point to a phase of short-term defensive position adjustments.

Spot Ethereum exchange-traded funds (ETFs) saw roughly $283.46 million exit in a single day, further dampening investor sentiment. Following Bitcoin ETFs, Ethereum ETFs also logged sizable fund withdrawals, reinforcing views that a broader risk-off tone is spreading across crypto ETFs.

According to data compiled by TraderT on the 21st, total net outflows from US spot Ethereum ETFs amounted to $283.46 million as of Jan. 21 (local time). With money leaving most major products, institutional investors’ cautious stance became more pronounced.

By product, BlackRock’s ETHA led the exodus with $246.78 million in net outflows. Fidelity’s FETH also saw $30.89 million leave, concentrating selling pressure among large asset managers.

Additional outflows included $4.42 million from VanEck’s ETHV and $11.38 million from Grayscale’s ETHE. By contrast, Bitwise’s ETHW, Invesco’s QETH and Franklin’s EZET posted no net flows, while the Grayscale Mini Trust ETH recorded $10.01 million in net inflows.

Market participants say that, alongside heightened volatility in Ethereum prices and large withdrawals from Bitcoin ETFs, Ethereum ETFs have also entered a phase of short-term defensive position adjustments. In particular, the sharp net outflow from BlackRock’s ETHA is interpreted as a sign that risk aversion among institutional money remains strong.

![[Key economic and crypto events for the week ahead] US FOMC policy-rate decision and more](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![Wall Street focuses on Fed chair nomination and Big Tech earnings…Shanghai stocks enter an earnings-driven market [New York·Shanghai stock outlook]](https://media.bloomingbit.io/PROD/news/b7d7a0aa-abf6-46e4-bbca-4270d970641d.webp?w=250)