Editor's PiCK

U.S. spot Ethereum ETFs log net outflows for three straight sessions

공유하기

Summary

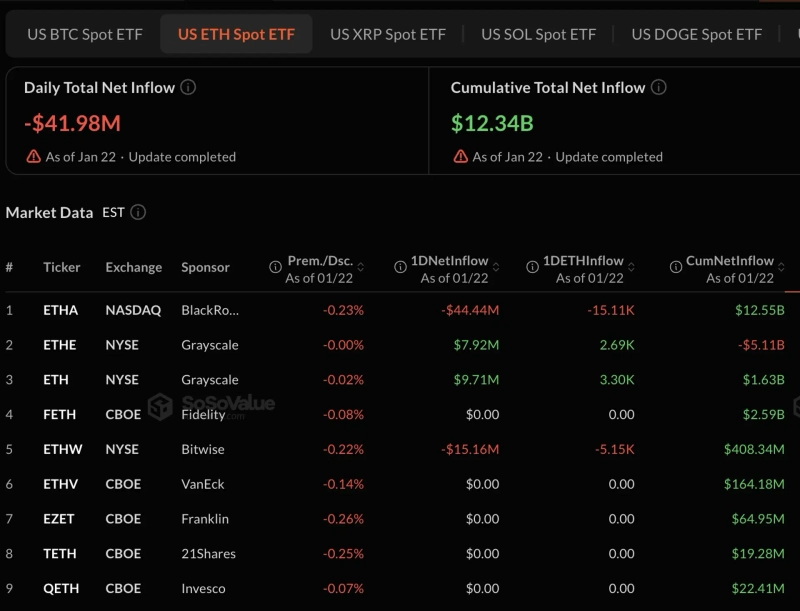

- U.S. spot Ethereum ETFs saw fund outflows for three consecutive days.

- On the 22nd, U.S. spot Ethereum ETFs posted daily net outflows of $41.98 million, while AUM fell to $17.73 billion.

- Large net outflows were seen in BlackRock’s ETHA and Bitwise’s ETHW, while Grayscale’s ETHE and ETH recorded modest net inflows.

U.S. spot Ethereum (ETH) exchange-traded funds (ETFs) extended net outflows for a third consecutive day.

According to SosoValue data dated the 22nd (local time), the group’s daily net outflow totaled $41.98 million, marking net outflows for three straight trading sessions.

As a result, cumulative net inflows into spot Ethereum ETFs slipped to $12.34 billion. Over the same period, total assets under management (AUM) also fell to $17.73 billion from $18.41 billion.

By product, the outflows were concentrated in a handful of ETFs. BlackRock’s ETHA alone saw $44.44 million leave in a single day, while Bitwise’s ETHW posted net outflows of $15.16 million.

In contrast, Grayscale’s ETHE and ETH recorded modest net inflows of $7.92 million and $9.71 million, respectively.

![[Analysis] “Bitcoin entering early stages of a bear market…focus on whether $84,000 holds as support”](https://media.bloomingbit.io/PROD/news/04082bef-8e1c-454d-958f-cfb2cd2f6554.webp?w=250)