Editor's PiCK

US spot Bitcoin ETFs see $19.65 million in net outflows…near-term supply-demand overhang persists

Summary

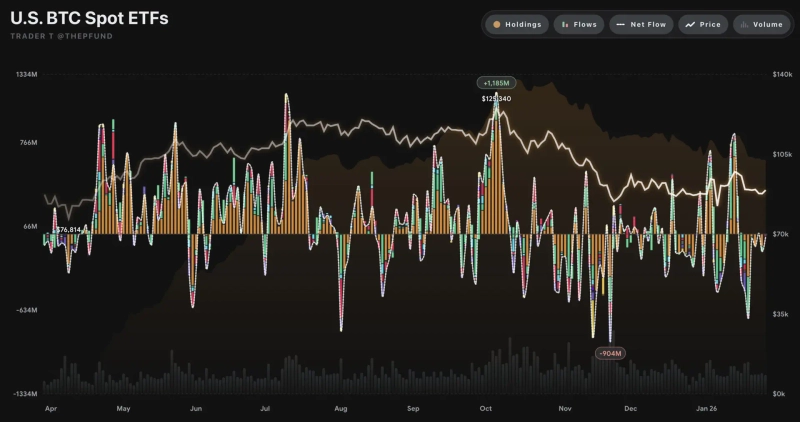

- US spot Bitcoin ETFs saw $19.65 million in net outflows in a single day, bringing near-term supply-demand pressure back into focus.

- While BlackRock IBIT, ARK Invest ARKB, and Bitwise BITB posted synchronized outflows, Fidelity FBTC’s $19.45 million net inflow failed to offset them.

- With the Bitcoin price moving sideways, ETF fund flows are diverging by manager, making whether spot ETF inflows resume a key factor for the near-term trend.

US spot Bitcoin exchange-traded funds (ETFs) recorded net outflows of about $19.65 million in a single day. With withdrawals continuing to be led by major asset managers, near-term supply-demand pressure has come back into focus.

According to data compiled by Trader T on the 28th (local time), total net outflows across US spot Bitcoin ETFs amounted to $19.65 million on the day. BlackRock’s iShares Bitcoin Trust (IBIT) posted the largest outflow, with $14.19 million leaving the fund.

ARK Invest’s ARKB also saw $12.30 million in net outflows, adding to the withdrawal trend. Bitwise (BITB) likewise recorded $12.61 million in outflows, reinforcing the weak tone.

By contrast, Fidelity’s FBTC drew $19.45 million in net inflows, providing a partial buffer. Still, it was not enough to offset the synchronized outflows from major ETFs including BlackRock, ARK and Bitwise.

No notable flow changes were seen in Invesco (BTCO), Franklin (EZBC), Valkyrie (BRRR), VanEck (HODL), WisdomTree (BTCW), and Grayscale’s GBTC and Mini Trust.

With Bitcoin trading rangebound, ETF flow data also remains directionless, showing mixed patterns across managers. As risk management via the options and derivatives markets continues, whether spot ETF inflows resume is likely to be key to the near-term trend.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE