[Analysis] "Bitcoin: Liquidity is the key variable…further downside if instability persists"

Summary

- Glassnode said Bitcoin could face an additional correction if instability in the crypto market and downside pressure persist.

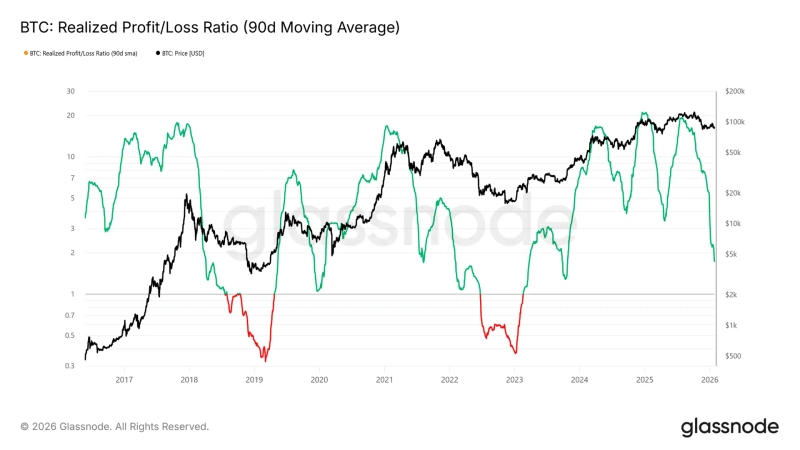

- Glassnode identified liquidity as the key variable, noting that the 90-day moving-average realized profit/loss ratio needs to rise above and hold at 5 to enable a shift into a strong bull phase.

- Glassnode said spot Bitcoin ETF flows are showing signs of stabilization, but warned that if the structure remains fragile, it cannot rule out a transition into further rangebound trading or a deeper correction phase.

An analysis suggests that Bitcoin (BTC) could face additional correction if instability in the cryptocurrency market persists and concerns about downside pressure continue to spread.

In its weekly report released on the 28th (local time), crypto analytics firm Glassnode said that "the environment for (Bitcoin) short-term holders (STH) remains unstable," adding that "if support levels break and investors recently shift into risk-off mode, additional selling pressure could emerge."

Glassnode pointed to liquidity as the key variable. It noted that "for (the market) to make a meaningful shift into a sustained uptrend, liquidity indicators such as the 90-day moving-average realized profit/loss ratio need to reflect that objectively," adding that "typically, when transitioning into a strong bull phase, it has been necessary for this indicator to rise above 5 and hold there."

On flows into spot Bitcoin exchange-traded funds (ETFs), it assessed that "structural buying has stabilized." Glassnode said that "institutional investors are showing a cautious stance rather than an aggressive risk-on posture," adding that "the fact that Bitcoin prices are holding at elevated levels despite weakening (ETF) inflow momentum suggests the market is relying more on spot investors’ conviction."

Glassnode also said that "overall capital flows are showing signs of stabilization." It added that "the key question for the market going forward is whether demand can be sustained across spot and ETFs overall," warning that "if the current fragile structure persists and demand for downside hedges increases, it cannot be ruled out that the market could enter an extended range or a deeper correction phase."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul