Editor's PiCK

Arthur Hayes: "Government hoarding cash ahead of a shutdown… Bitcoin’s decline is a natural development"

Uk Jin

Summary

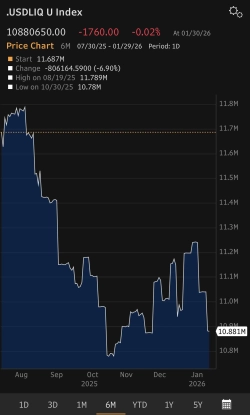

- Arthur Hayes said dollar liquidity has fallen by about $300 billion in recent weeks.

- He noted that $200 billion of the decline came from a rise in the U.S. Treasury’s General Account (TGA) balance.

- Hayes said the decline in dollar liquidity driven by the government’s cash buildup ahead of a shutdown makes the drop in Bitcoin’s price a natural development.

Bitcoin (BTC) plunged sharply intraday, with the drop attributed to tightening dollar liquidity.

On the 30th (KST), Arthur Hayes, co-founder of BitMEX, wrote on X (formerly Twitter) that “over the past few weeks, dollar liquidity has fallen by about $300 billion,” adding that “$200 billion of that came from an increase in the U.S. Treasury General Account (TGA) balance.”

Hayes went on to say, “It looks like the government is raising cash to prepare for a shutdown,” explaining that “given the decline in dollar liquidity, a drop in Bitcoin’s price is not surprising.”

As of 4:42 p.m. this afternoon, Bitcoin is trading at $82,418, down 6.48% from the previous day.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)

![Liquidity strains deepen as trading volume contracts and funds exit…Can altcoins rebound? [Kang Min-seung’s Altcoin Now]](https://media.bloomingbit.io/PROD/news/5fa259b1-0308-4c7b-9259-04f38ad8fc2a.webp?w=250)