Summary

- Bitcoin’s price plunged 40%, but outflows from spot Bitcoin ETFs were limited to 6.6% of assets under management.

- Mainstream ETF investors treat Bitcoin as a 1–2% ‘hot sauce’ allocation and are absorbing losses thanks to gains from their traditional-asset portfolios.

- This downturn was driven not by ETF redemptions but by futures-market leverage liquidations and profit-taking by long-term holders, with Bitcoin ETFs seen as helping to keep Bitcoin anchored even during selloffs.

The crypto market has been hit by an intense deep freeze, with Bitcoin plunging more than 40% from its peak, but investors in spot exchange-traded funds (ETFs) do not appear to have rushed to dump their holdings.

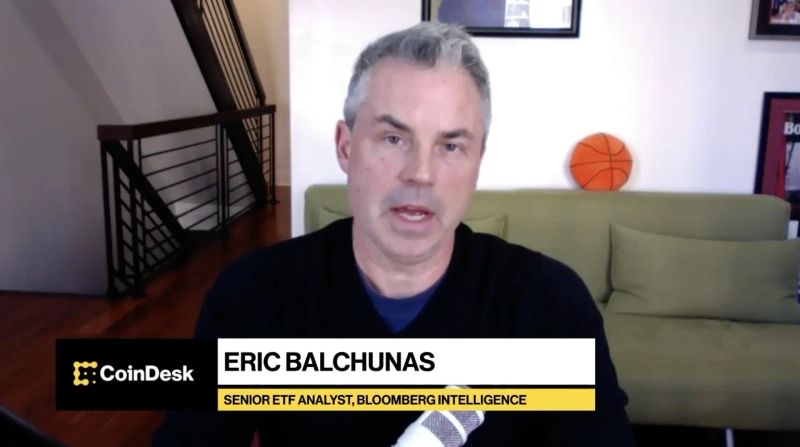

On the 6th (local time), Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, said in an interview with CoinDesk that “even amid Bitcoin’s sharp selloff, ETF investors are holding up surprisingly well,” adding that “the data so far suggest so-called ‘ETF boomers’ (Boomer—baby boomers and other mainstream institutional investors) are acting as a backstop for the market.”

According to Balchunas’ analysis, while Bitcoin has fallen more than 40% from its recent high, outflows from spot Bitcoin ETFs amounted to just 6.6% of total assets under management (AUM). Typically, a 40%-plus drop in crypto stokes fears of a downturn and triggers large-scale exits, but this time was different.

He attributed the phenomenon to structural differences between ETF investors and traditional coin investors. Mainstream investors who buy ETFs tend to view Bitcoin as “hot sauce” that makes up only about 1–2% of their overall assets. Balchunas explained, “For them, Bitcoin is just seasoning to add flavor, not a core holding.”

He also said that the recent strength in traditional asset markets, including US equities, has softened the psychological hit. With their overall portfolios generating gains as stocks rise, they see losses in Bitcoin as manageable.

By contrast, retail investors concentrated in crypto or leveraged traders took a direct hit. Balchunas noted, “For investors with most of their assets piled into crypto, a 40% drop feels like a threat to survival,” while “ETF investors who have allocated assets have built resilience over decades of stock-market ups and downs.” In fact, the selling pressure that drove this downturn is understood to have come not from ETF redemptions but from leverage liquidations in the futures market and profit-taking by existing long-term holders.

He said, “The momentum that allowed Bitcoin ETFs to grow rapidly enough to threaten gold ETFs’ dominance right after launch is being proven even in a selloff,” adding, “Volatility will remain, but the ETF wrapper is holding Bitcoin tightly.” He continued, “Bitcoin has repeatedly suffered sharp crashes and rebounds over the past 17 years, setting new record highs,” and added, “For ETF investors, this decline is not the end—just one of many market cycles.”

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀