Editor's PiCK

"No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]

Summary

- Bitcoin fell to the $60,000 level, and buying sentiment was said to have weakened after the U.S. Treasury Secretary remarked on the absence of a government-level backstop.

- Ethereum plunged more than 30% in a week, sliding below $2,000, and net outflows from spot ETF funds were reported to have continued for a third straight month.

- Dogecoin was described as being in a technically weak phase, retesting the key $0.10 support and facing the possibility of a sharp decline if the $0.080 support breaks.

<Lee Su-hyun’s Coin Radar> is a weekly column that tracks the flow of the virtual asset (cryptocurrency) market and explains the backdrop. Going beyond a simple list of price moves, it provides a multidimensional analysis of global macro issues and investor positioning, offering insights to help gauge the market’s direction.

Major Coins

1. Bitcoin (BTC)

Bitcoin extended its brake-free slide this week, ultimately falling to the $60,000 level. It was the first time Bitcoin touched the $60,000 handle since November 2024. As of the 6th, it is trading around $64,000 on CoinMarketCap.

Early-week losses were attributed to the so-called “Warsh shock.” With Kevin Warsh—seen as a strongly hawkish contender for the next Fed chair—being tapped, expectations for rate cuts cooled rapidly and risk assets broadly lost momentum. Bitcoin struggled to avoid the spillover.

The decisive trigger was concentrated on the 4th (local time). That day, U.S. Treasury Secretary Scott Bessent drew a line in congressional testimony, saying in effect that “the government has no authority to intervene even if the Bitcoin price collapses.” The market took it as a message that there is “no government-level backstop,” even under U.S. President Donald Trump’s administration. Risk appetite shrank sharply, widening Bitcoin’s decline.

Some also said warning remarks from Michael Burry, the protagonist of the film The Big Short, fanned fear. In a Substack post on the 2nd, Burry argued that “a Bitcoin decline could spread into a ‘death spiral’ that leads to damage for related companies,” adding that “if Bitcoin falls further, financing conditions could deteriorate sharply for Strategy, a Bitcoin treasury company.” CNBC reported that volatility in Bitcoin and related exchange-traded funds (ETFs) increased after the remarks. Then on the 5th, after Bitcoin broke below the $70,000 level, Burry further stoked fear by saying Bitcoin would suffer a crash similar to the one seen during the 2022 bear market.

On the policy front, discussions continue around the CLARITY Act, a U.S. market-structure bill for the digital-asset sector. On the 3rd, the White House met with industry and banks to discuss the bill’s key sticking point—the “stablecoin rewards” provision—but failed to reach a clear agreement. The White House has asked for a compromise proposal by the end of this month. Procedurally, hurdles remain, including passage through the Senate Banking Committee and crafting a unified bill across the Agriculture and Banking committees, followed by House-Senate coordination. Still, some see the bill’s approval within the year as remaining on the table. CoinShares argues the CLARITY Act is also feasible, given that the GENIUS Act, last year’s U.S. stablecoin bill, passed after overcoming obstacles. However, there are also warnings that legislative momentum could fade as the second half approaches, with 2026 being a midterm election year.

Views diverge on the price outlook. Bernstein suggested Bitcoin could form a bottom around the $60,000 level and enter a recovery phase in the first half, framing the pullback as a retracement within a broader up-cycle. By contrast, on-chain analyst Ananda Banerjee warned that unless spot demand clearly recovers, the market should keep open the possibility of additional declines across the $63,000 to $69,000 range. In the near term, volatility is likely to persist, and the prevailing view is that it is too early to declare a bottom at current levels.

2. Ethereum (ETH)

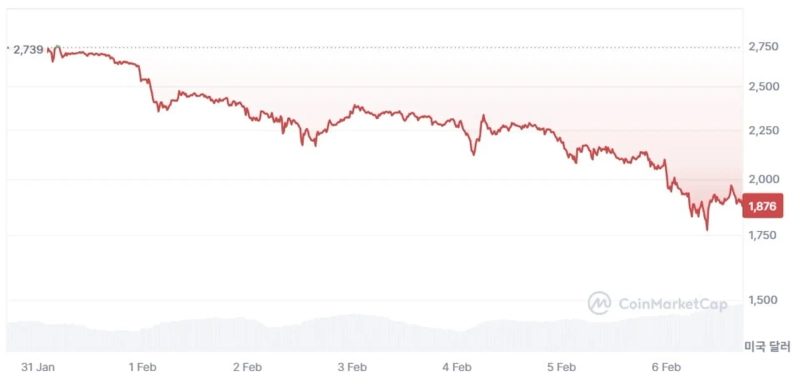

Ethereum also saw sharp swings this week. Losses deepened in tandem with Bitcoin’s slide, and on CoinMarketCap it fell more than 30% over the week, slipping below $2,000. As of the 6th, it is hovering around $1,900.

Sentiment took a hit after reports that Ethereum founder Vitalik Buterin sold part of his holdings earmarked for ecosystem support. On the 5th, Vitalik was shown to have sold 27.6% of 16,384 ETH he had planned to deploy to support the Ethereum ecosystem. The amount sold so far is about 4,521 ETH ($9,939,000), with the average sale price estimated at $2,202. The value totals about $10,000,000. With the selling believed to still be ongoing, additional sales could emerge at any time.

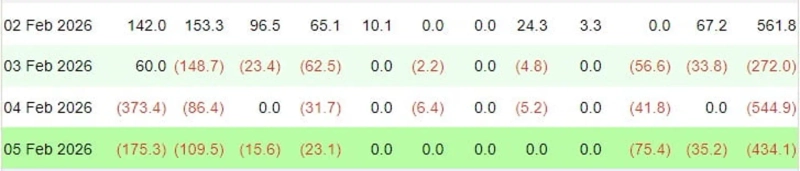

Institutional flows also remain a headwind. On the 5th, based on TraderT, roughly $80.79 million left U.S. spot Ethereum ETFs in a single day, and on a monthly basis net outflows have continued for three consecutive months. With institutional demand yet to show a clear recovery, some expect volatility could increase.

Further downside risk is being raised in the short term. Crypto-focused outlet Cointelegraph says the $1,700 range should also be kept in view, while arguing that to discuss a meaningful trend reversal, the $2,300–$2,400 zone needs to be reclaimed.

3. XRP (XRP)

XRP slipped below the $2 level, and as its rebound lost steam, it has now fallen to the low-$1 range. As of the 6th, it is trading around $1.2 on CoinMarketCap.

Analysts say the decline reflects an overlap of a technical breakdown and shifts in on-chain supply and demand. Technically, a break of a key support level is seen as decisive. On the 5th, crypto outlet CoinDesk noted that “as XRP clearly broke below the $1.60 area, the perception spread that ‘the price zone that would hold has weakened.’” The market may view the area down to $1 as an “air pocket” with a thin supply overhang, suggesting that once a decline starts, the downside could open faster than expected.

On-chain metrics also point to an expanding phase of selling pressure. According to CryptoQuant, XRP exchange reserves rose from 2.67 billion to 2.71 billion. Typically, increased exchange inflows during volatile periods are read as a signal of potential supply expansion. In derivatives markets as well, commentators said position unwinds outweighed fresh inflows. XRP futures open interest fell from $2.61 billion to $2.57 billion, reinforcing assessments that rebound momentum has weakened.

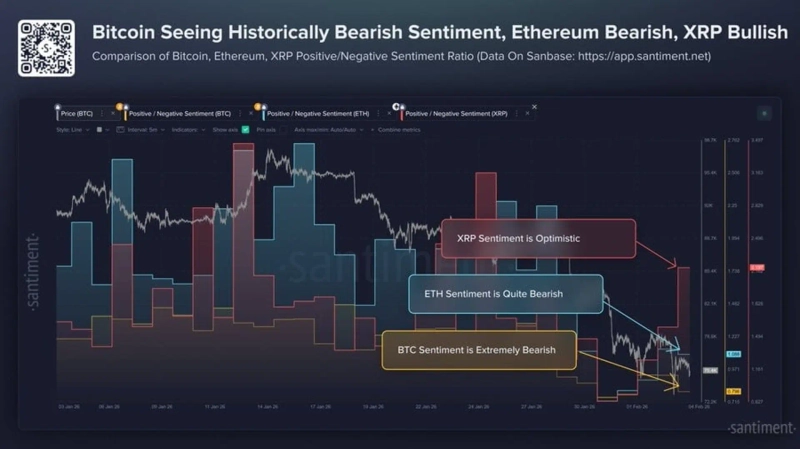

That said, some note that XRP community sentiment tends to diverge from price. According to on-chain analytics platform Santiment, XRP is maintaining much stronger bullish sentiment on social media than Bitcoin or Ethereum. Its positive-to-negative sentiment index was more than twice that of Ethereum and more than 170% higher than Bitcoin’s. This could cushion selling pressure in the short term, but it may also signal that risks are being underestimated.

Overall, caution dominates the outlook. CoinDesk said the uptrend has broken and projected that in extreme cases the $1 level should also be kept open. NewsBTC analyst Aayush Jindal warned of further downside if XRP fails to regain the $1.5320 resistance.

Issue Coins

1. Dogecoin (DOGE)

Dogecoin also slid more than 20% over the week on CoinMarketCap, dropping below the $0.10 level. As of the 6th, it is trading around $0.09.

The backdrop to Dogecoin returning to the spotlight this week was the rekindling of the Elon Musk–SpaceX narrative. On the 3rd, Musk replied on X to a post referencing his past remark that SpaceX would “literally send Dogecoin to the Moon,” responding, “Maybe next year.” After previously reacting with a brief “Yes,” he added further comments, once again drawing market attention to Dogecoin.

Still, the prevailing view is that while Musk-related headlines remain a “catalyst,” their price impact is not what it used to be. The DOGE-1 lunar mission has been delayed multiple times in the past, leaving the timeline uncertain, and this time as well no specific schedule or execution plan has been disclosed.

Technically, analysis suggests it is moving within a bearish channel. Crypto outlet CoinGape said Dogecoin “has remained in a falling channel with lower highs since late 2025,” and summarized the price action as failing to rebound even after confirming support near $0.108 following a drop below $0.11, returning to test the key $0.10 support. It also noted that in a period of heightened Bitcoin volatility, sentiment-sensitive assets like Dogecoin can see buying interest dry up quickly.

Looking ahead, the key is whether the $0.08 support level holds. Crypto outlet NewsBTC said if Dogecoin fails to defend the $0.080 support, a sharp drop could appear to $0.0750, and even lower. Conversely, if a technical rebound emerges, the area around $0.090 is cited as the first resistance, with the zone where $0.0950 intersects the downtrend line flagged as the most important near-term resistance.

Lee Su-hyun, Bloomingbit reporter shlee@bloomingbit.io

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!["No U.S. government backstop" shock…Bitcoin retreats to the $60,000 level; Ethereum also rattled [Lee Su-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/a68e1192-3206-4568-a111-6bed63eb83ab.webp?w=250)