Editor's PiCK

Digital-asset investment products see $187m in net outflows last week…pace of withdrawals slows

Summary

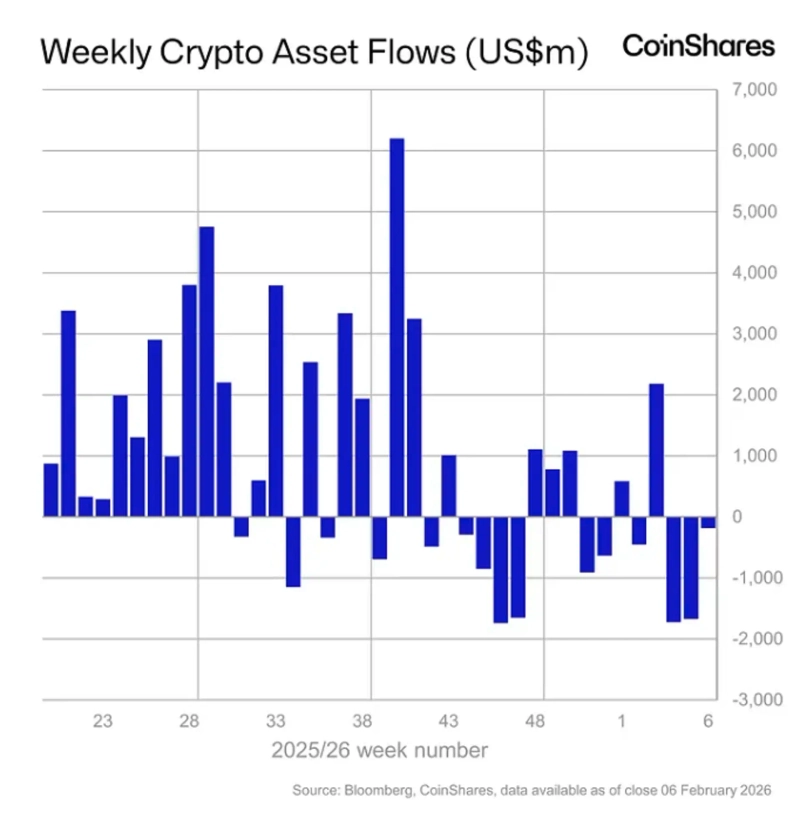

- Digital-asset investment products posted $187 million in net outflows, but the slower pace of withdrawals raised the possibility of market stabilization.

- The latest price correction pushed assets under management (AuM) down to $129.8 billion, while weekly ETP turnover hit a record $63.1 billion.

- Bitcoin investment products saw $264 million in net outflows, but XRP, Solana and Ethereum attracted inflows, signaling selective buying centered on some altcoins.

An analysis suggests that the pace of fund outflows from digital-asset investment products is slowing, raising the possibility of market stabilization.

According to CoinShares’ weekly fund flows report released on the 9th, global digital-asset investment products recorded net outflows totaling $187 million last week. This marks a sharp reduction in outflow volume despite recent price weakness.

James Butterfill, head of research at CoinShares, said, “More important than the size of the outflows themselves is the fact that the pace of withdrawals is slowing,” adding, “Historically, this kind of trend has often signaled an inflection point in investor sentiment.”

Following the latest price correction, assets under management (AuM) in digital-asset investment products fell to $129.8 billion. That level matches the one seen after the US tariff announcement in March last year, when asset prices also formed a short-term trough. Meanwhile, trading activity surged, with weekly turnover in exchange-traded products (ETPs) hitting a record $63.1 billion.

Regional flows were mixed. Germany posted net inflows of $87.1 million, while Switzerland ($30.1 million), Canada ($21.4 million) and Brazil ($16.7 million) also saw inflows. The moves suggest that some investors in parts of Europe and the Americas treated the pullback as a buying opportunity.

By asset, Bitcoin (BTC) investment products saw net outflows of $264 million, reflecting relatively negative sentiment. In contrast, XRP ($63.1 million), Solana ($8.2 million) and Ethereum ($5.3 million) drew inflows, pointing to selective buying concentrated in certain altcoins. XRP recorded the largest net inflows year-to-date on a cumulative flows basis.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Analysis] "Bitcoin attempts a technical rebound after capitulation selling…trend reversal hinges on fresh inflows"](https://media.bloomingbit.io/PROD/news/067f7da2-2764-45b9-a79c-b8a9c31d4919.webp?w=250)