Summary

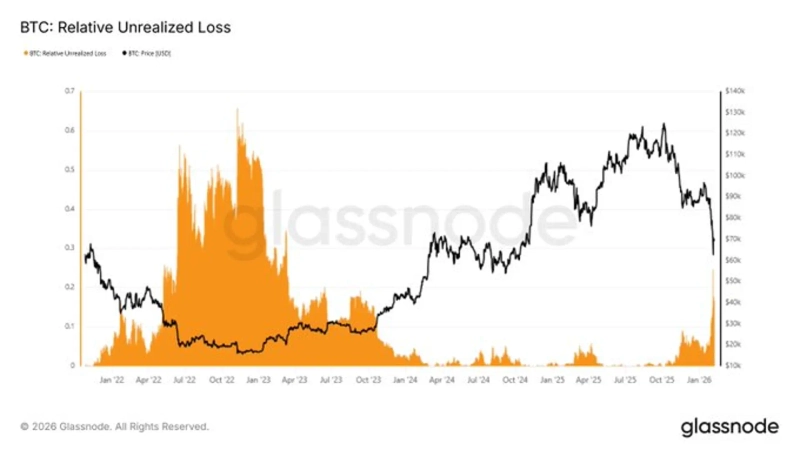

- Glassnode said that when Bitcoin (BTC) trades around $70,000, unrealized losses amount to about 16% of market cap.

- It explained that the current market pain zone is similar to the structure observed in early May 2022.

- It said this implies that a substantial number of investors are in a loss position versus their purchase prices.

With Bitcoin (BTC) trading around the $70,000 level, an analysis suggests that the scale of unrealized losses across the broader market has reached a significant level relative to market capitalization.

On the 9th, on-chain analytics firm Glassnode said via X (formerly Twitter) that "when Bitcoin's price is around $70,000, the market's unrealized losses amount to about 16% of market capitalization." It added that "the market's current pain zone is similar to the structure observed in early May 2022."

This implies that a substantial number of investors are sitting on losses relative to their purchase prices.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.![[Today’s key economic and crypto calendar] Remarks by Fed Governor Christopher Waller, among others](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[New York Stock Market Briefing] AI tech shares draw bargain hunting, lifting markets together… Dow sets another record high](https://media.bloomingbit.io/PROD/news/c018a2f0-2ff5-4aa8-90d9-b88b287fd926.webp?w=250)