PiCK

"Barometer of institutional sentiment"… Coinbase’s Q4 results flash a warning sign

Summary

- The consensus estimate for Coinbase’s Q4 revenue was tallied at $1.85 billion, down about 16% from a year earlier, signaling a warning sign for the barometer of institutional sentiment.

- Coinbase’s trading volume forecast is estimated at $279 billion, a 36.5% plunge year on year, while Bitcoin returns also worsened to -23.07%, heightening concerns about weak results.

- Citigroup lowered its Q4 revenue forecast for Coinbase to $1.69 billion and cut its price target to $400 from $505, saying progress on the Clarity Act is a key catalyst for stock momentum.

Investors are turning their attention to the earnings release of U.S. cryptocurrency exchange Coinbase, scheduled for later this week. With cryptocurrency sentiment having cooled after a sharp drop in Bitcoin (BTC), the market impact of Coinbase’s results is in focus.

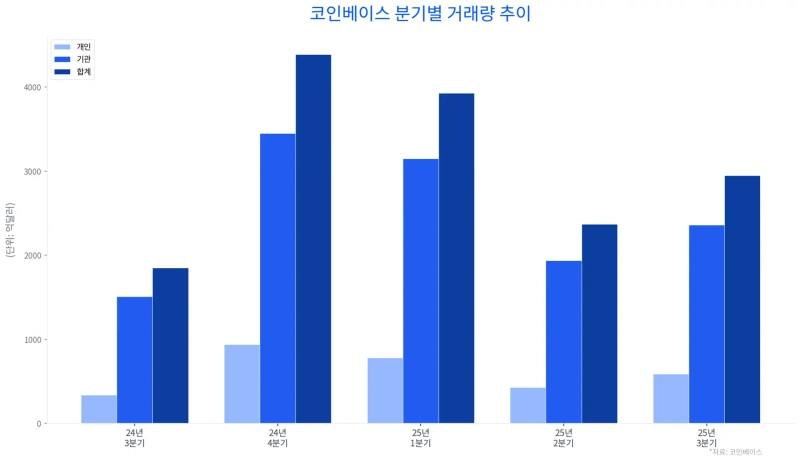

According to industry sources on the 10th, Coinbase will report its earnings for the fourth quarter of last year at 7:30 a.m. on the 13th (Korea time). The market is watching Coinbase’s results to gauge U.S. institutional investors’ demand for crypto. Institutions account for 75–80% of Coinbase’s trading volume. That means performance metrics such as quarterly trading volume and revenue can serve as a ‘barometer’ of institutional sentiment.

The outlook for the fourth quarter is not bright. According to U.S. investment research firm Zacks Investment Research, the consensus estimate (average market forecast) for Coinbase’s Q4 revenue last year stands at about $1.85 billion. That is down nearly 16% from a year earlier ($2.197 billion).

A key driver behind the shrinking revenue outlook is a decline in trading volume. Coinbase’s projected Q4 trading volume was tallied at $279 billion, a roughly 36.5% plunge from the year-ago period ($439 billion). It is also more than 5.3% lower than the prior quarter ($295 billion).

Experts say Coinbase’s results could come in weaker than expected, as prices of major cryptocurrencies such as Bitcoin struggled throughout the fourth quarter following a large-scale liquidation event in October last year. According to CoinGlass, Bitcoin’s Q4 return last year was -23.07%, turning negative for the first time in three years since 2022 (-14.75%). By the size of the drop alone, it is the largest in seven years since 2018 (-42.16%).

Performance in exchange-traded funds (ETFs), which reflect institutional flows, is also deteriorating. According to Sosovalue, U.S. spot Bitcoin ETFs saw $1.15 billion (about KRW 1.7 trillion) in net outflows in the fourth quarter of last year. This is the first time since their launch in 2024 that spot Bitcoin ETFs have recorded net outflows on a quarterly basis.

This context also underpins why global investment bank (IB) Citigroup recently cut its Q4 revenue forecast for Coinbase to $1.69 billion. Citigroup also lowered its price target on Coinbase to $400 from $505, a cut of more than 20%. The firm maintained its rating at ‘Buy/High Risk.’ Coinbase shares closed at $167.25 in the previous session (the 9th).

A key variable that will shape the stock’s direction is the U.S. crypto market structure bill (the Clarity Act). Despite the White House’s strong push for legislation, the bill remains pending in the U.S. Senate, held back by differences between banks and the crypto industry over ‘interest payments on stablecoins.’ Citigroup said, “Progress on the Clarity Act is a key catalyst to revive Coinbase’s stock momentum.”

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul