PiCK

Jobs surprise and AI overhang collide…Fears grow of rising volatility as Bitcoin meets $70,000 resistance [Kang Min-seung’s Trade Now]

Summary

- Analysts said that if Bitcoin fails to break above the $70,000 resistance in the short term, it could remain range-bound in a $60,000–$70,000 box with potential for further pullbacks.

- The report said that despite net inflows into spot Bitcoin ETFs, upside momentum and ETF inflow momentum are limited due to factors such as the absence of retail buying and a decline in USDT liquidity.

- Several analysts said that if the $60,000 support breaks, Bitcoin could fall toward $57,800, $52,500, or even the $40,000–$50,000 range, and warned investors to brace for heightened volatility over the coming months.

Robust jobs data and concerns over overheating in the artificial intelligence (AI) theme are combining to drive greater volatility across global risk-asset markets. With U.S. January employment far exceeding expectations, uncertainty over the timing of rate cuts has resurfaced, while Bitcoin (BTC) is extending its weakness in tandem with the pullback in tech stocks.

Analysts say that if Bitcoin fails to break above the $70,000 resistance in the near term, additional downside is possible. With fear lingering, prices are expected to remain range-bound between $60,000 and $70,000 for now, and the risk of heightened volatility due to fading upside momentum is also being raised.

As of 12:48 p.m. on the 13th, Bitcoin was trading at $66,555 on Binance’s USDT market, down 1.4% from the previous day. On Upbit’s KRW market, the price was 97.59 million won. At the same time, the “kimchi premium” (the price gap between overseas and domestic exchanges) stood at 1.6%.

“Rate cuts are further away”…Liquidity uncertainty widens amid Japan- and China-driven factors

Global equities and digital assets (cryptocurrencies) are extending losses together as concerns grow over AI-related debt burdens. In New York, market caution has been fueled by the massive borrowing needed to expand AI infrastructure, while strong jobs data has added to expectations that the U.S. Federal Reserve (Fed) could delay the start of rate cuts—further stoking risk-off sentiment.

Earlier, the U.S. Labor Department said on the 11th that January nonfarm payrolls rose by 130,000—more than double the market consensus. The unemployment rate was also 4.3%, below the forecast of 4.4%. It effectively reaffirmed that the labor market remains close to full employment.

U.S. President Donald Trump commented on the “surprise jobs” figure, saying, “We’ve become the strongest country in the world again, and therefore we should be paying the lowest interest rates.” The remarks were seen as praising the employment strength while simultaneously emphasizing the need for accommodative monetary policy. Inside the Fed, however, calls for caution on future policy are also emerging.

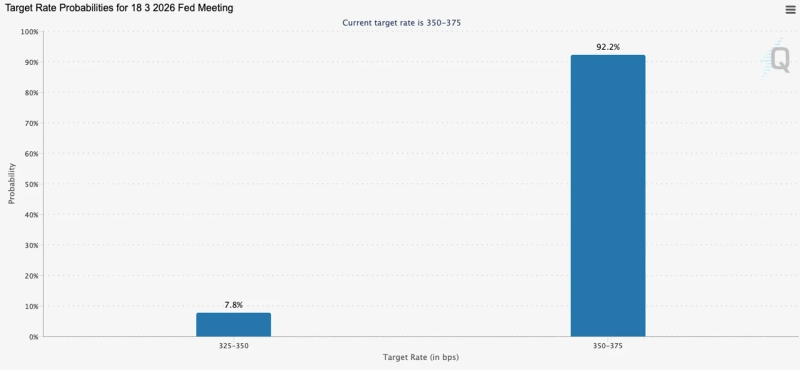

At 1 p.m. that day, CME’s FedWatch Tool showed the interest-rate futures market pricing in a 92.2% probability that rates will be held steady in March, sharply up from 79.9% previously. As strong employment reinforces the Fed’s stance of keeping rates higher for longer, market expectations are being repriced in a more hawkish direction.

Markets are focusing on the U.S. January consumer price index (CPI), due at 10:30 p.m. on the 13th (Korea time). If inflation comes in above expectations, concerns are rising that the Fed’s policy stance could tilt even more hawkish. Analysts say that if both jobs and inflation remain firm, the start of rate cuts is likely to be pushed back further.

Meanwhile, uncertainty around global capital flows is also increasing as macro factors from Japan, the U.S. and China intersect. In Japan, Prime Minister Sanae Takaichi, after the ruling Liberal Democratic Party’s landslide victory in a House of Representatives election, said she would “pursue responsible proactive fiscal policy,” signaling a stance toward fiscal expansion. Adding to that, China’s authorities’ restraint on new purchases of U.S. Treasuries has raised concerns over instability in government-bond supply and demand and greater volatility in market rates.

“No retail buying…ETF momentum limited despite easing outflows”

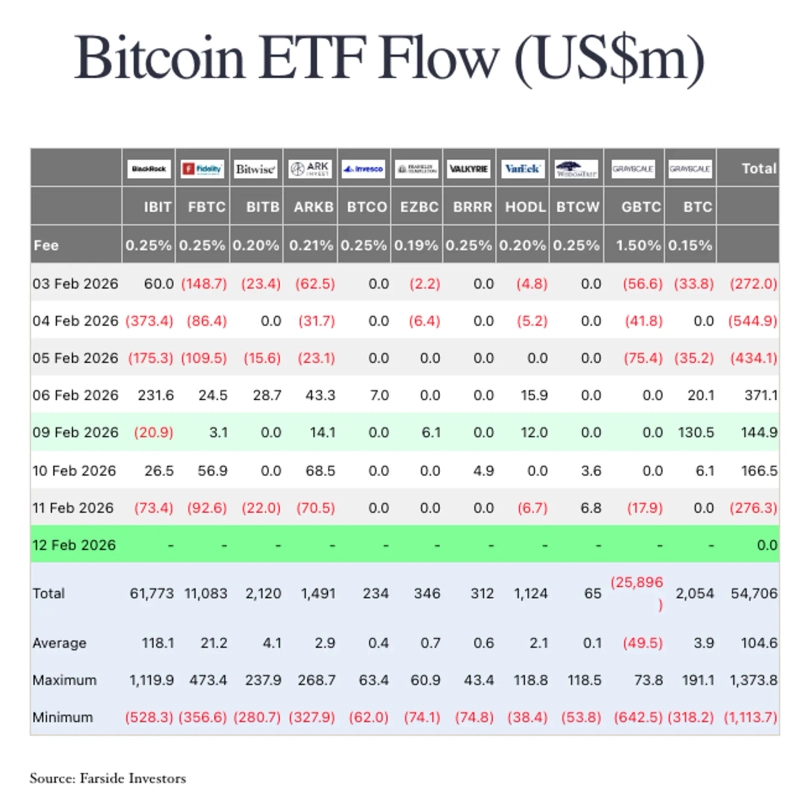

Spot Bitcoin exchange-traded funds (ETFs) recorded net inflows of $35.10 million this week (9–11). While the recent run of outflows appears to be easing for now, some say it is too early to view this as a sustained recovery.

Crypto services firm Matrixport said in a research report on the 11th that “retail participation, which has historically driven the upside momentum in crypto markets, has not been notable for more than a year,” adding that “using Korean trading volume as a proxy indicator, retail buying remains limited.” It also argued that “if retail demand is lacking, institutions’ incentive for arbitrage between spot and futures weakens, which could also constrain ETF inflows.”

Global crypto exchange Bitfinex also said that “the recent decline was led by aggressive spot selling rather than liquidations,” adding that “spot supply was released heavily during U.S. trading hours.” The report noted that derivatives open interest (OI) fell from the record high of $92.4 billion to $44.7 billion, indicating that a significant portion of leveraged positions has been unwound.

It also said that “long-term holder supply is rising again to 14.30 million BTC,” adding that “this may be interpreted as an early accumulation signal, and historically it has tended to be followed by a price rebound 3–4 months later.”

The possibility of greater volatility amid shifting macro conditions is also being raised. Singapore-based crypto trading firm QCP Capital said, “Bitcoin is currently behaving not like a safe-haven asset in a risk-off regime, but like a high-risk asset similar to equities,” adding that “in that case, volatility tends to increase as the macro environment deteriorates.” On-chain research firm Axel Adler Jr. Dotcom said that “USDT liquidity fell by $2.87 billion over the past 30 days, tightening overall market funding conditions.”

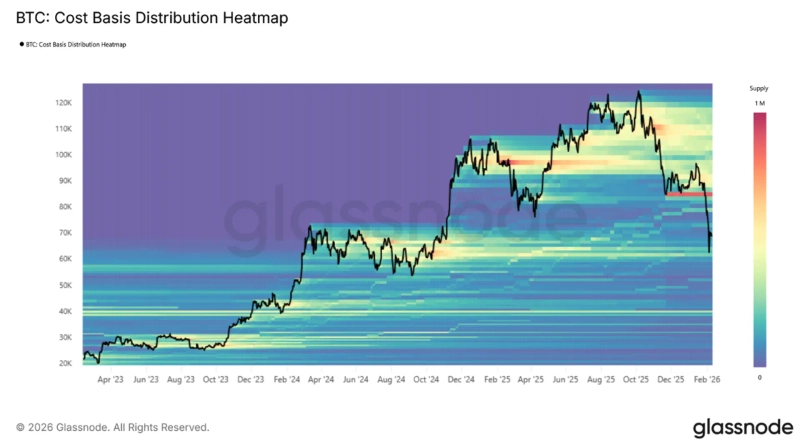

Some also say more time is needed before Bitcoin finds a clear direction. On-chain analytics firm Glassnode said in its weekly report that “Bitcoin is fluctuating between $55,000 and $79,200,” describing the environment as similar to 2Q 2022, “when new buying demand had to gradually absorb supply.” It added that “the large supply overhang formed in the $82,000–$97,000 range could act as overhead resistance on each rebound.”

“Bitcoin faces $70,000 resistance…Break below $60,000 could deepen losses”

The market is also seeing analysis that downside risks remain for Bitcoin even after the recent sharp drop.

Ayush Jindal, a NewsBTC researcher, said, “If Bitcoin fails to break above the $69,000 resistance in the short term, further declines could follow,” adding that “if the $66,000 and $65,000 support levels give way, it could retreat through $62,000 to around $61,200.” He added that “if it climbs above $68,200–$69,000, it could retest the psychological resistance at $70,000 and continue rebound attempts.”

Rakesh Upadhyay, a Cointelegraph analyst, also said, “With spot selling continuing, the door is open for a retest of $60,000,” adding that “if the price stays below $67,300, it could slide through $62,345 to around $60,000.” He warned that “if the $60,000 support breaks on a closing basis, the decline could extend to $52,500.” Still, he said that “if it recovers the key resistance at $72,271 and breaks above $76,275, the possibility of a short-term trend reversal also opens up.”

Investor sentiment has also cooled sharply. Alex Kuptsikevich, chief market analyst at FxPro, said, “The Fear & Greed Index fell to 5, the lowest level since August 2019,” calling it “a zone similar to the June 2022 Luna incident.” He added, “Bitcoin remains in a descending channel with lower highs, but it is not yet in the cycle-bottom zone,” and said he expects “a range-bound move between $60,000 and $70,000 over the coming weeks.”

Concerns over greater volatility are also growing alongside weakening trend momentum. Katie Stockton, founder of Fairlead Strategies, said, “If Bitcoin clearly falls below $70,000, the pullback could deepen toward the next major support around $57,800.” She added, “With the momentum of the uptrend weakening, we need to brace for the possibility of increased volatility over the coming months.”

From a longer-term perspective, caution around the downside zone persists. Crypto analytics firm Kaiko Research said, “This correction is still limited compared with past bear markets,” adding that “taking the previous cycle into account, we cannot rule out the possibility that a bottom forms between $40,000 and $50,000.”

Kang Min-seung, Bloomingbit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![Jobs surprise and AI overhang collide…Fears grow of rising volatility as Bitcoin meets $70,000 resistance [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/95764d70-5a3d-4300-b834-25c6a366c3a5.webp?w=250)

![Evernorth: “XRP Is Central to Next-Generation Finance…A Downturn Is a Buying Opportunity” [Cointerview]](https://media.bloomingbit.io/PROD/news/3c5ebde2-c604-4886-aa3e-b8c1e0c600c4.webp?w=250)