Summary

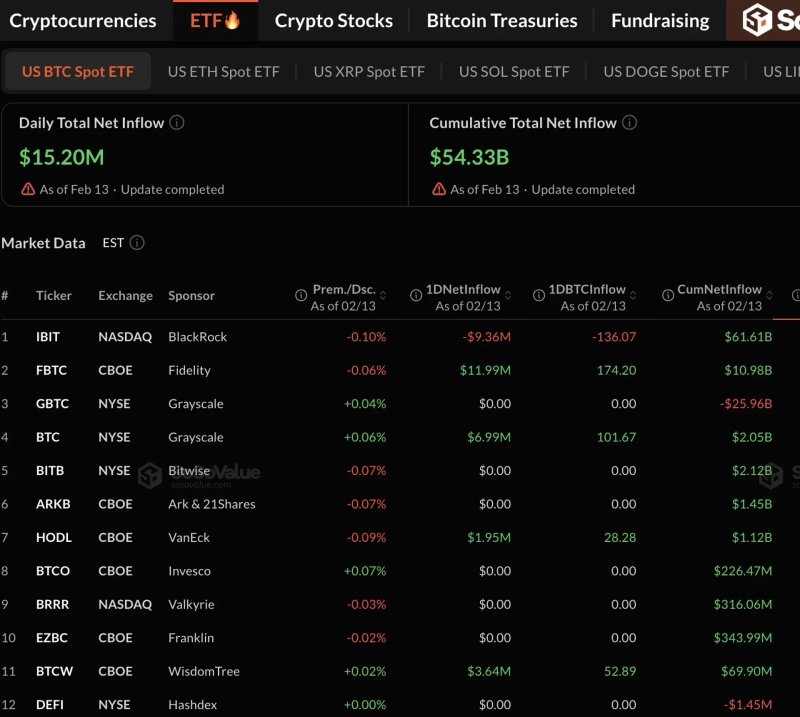

- A total of $15.2 million flowed into 12 US spot Bitcoin ETFs, marking a return to net inflows after two days.

- Inflows went to Fidelity’s FBTC ($11.99 million), as well as Grayscale’s BTC, WisdomTree’s BTCW, and VanEck’s HODL.

- BlackRock’s IBIT posted $9.36 million in net outflows, extending weakness, but outflows shrank sharply from the prior day, indicating easing selling pressure.

US spot Bitcoin exchange-traded funds (ETFs) returned to net inflows after two days. Outflows from BlackRock’s IBIT persisted, but sentiment turned as buying interest flowed in, led by Fidelity’s FBTC.

According to data from SosoValue, a digital-asset data platform, the 12 US spot Bitcoin ETFs posted total net inflows of $15.2 million on the day.

Fidelity led the inflows. Its FBTC recorded net inflows of $11.99 million, helping to cushion downside pressure in the market.

Next, Grayscale’s fee-cut product BTC also drew $6.99 million. WisdomTree’s BTCW and VanEck’s HODL added support, posting net inflows of $3.64 million and $1.95 million, respectively.

By contrast, BlackRock’s IBIT logged net outflows of $9.36 million, extending a softer trend. However, the scale of outflows fell sharply from the previous day (about $157 million), suggesting selling pressure is easing.

Meanwhile, the remaining seven funds—including Grayscale (GBTC), Bitwise (BITB), ARK 21Shares (ARKB) and Invesco Galaxy (BTCO)—were flat, with no inflows or outflows.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀