Summary

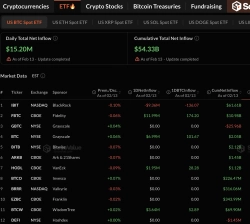

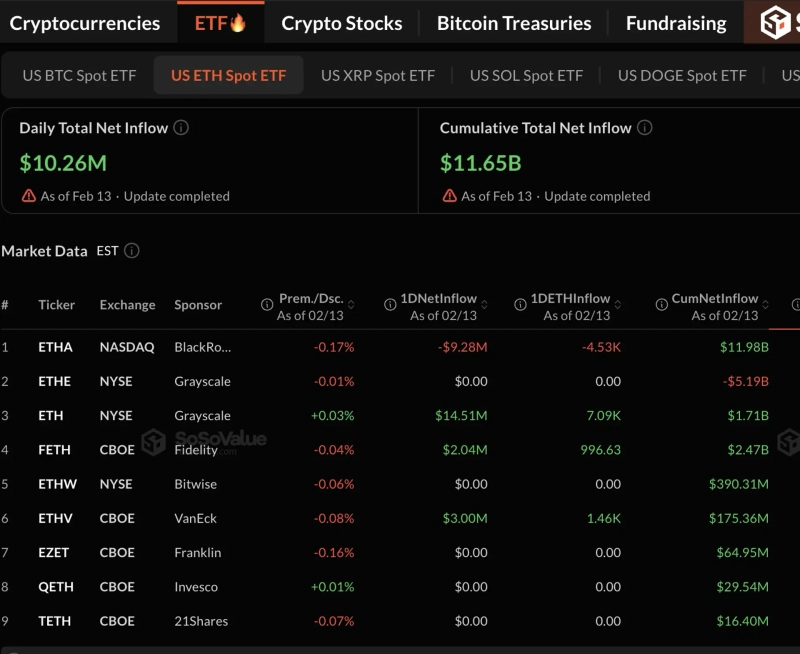

- A total of $10.26 million in net inflows was recorded across nine US spot Ethereum ETFs, indicating renewed buying interest.

- Grayscale’s ETH drew $14.51 million in net inflows, while ETHV and FETH also took in funds, helping drive the advance.

- BlackRock’s ETHA posted $9.28 million in net outflows for a second straight session, while the other five products ended flat with no flows.

US spot exchange-traded funds (ETFs) tracking Ethereum also returned to net inflows after two days. As with Bitcoin, buying interest flowed in, reversing market sentiment. In particular, Grayscale Mini Trust (ETH) absorbed selling from BlackRock (ETHA), helping drive gains.

According to data from crypto asset data platform SosoValue on the 13th (local time), the nine US spot Ethereum ETFs saw total net inflows of $10.26 million on the day.

The rebound was led by Grayscale’s ‘ETH’. ETH posted net inflows of $14.51 million, the largest among the ETFs. VanEck’s ‘ETHV’ and Fidelity’s ‘FETH’ also saw inflows of $3.00 million and $2.04 million, respectively, adding support.

By contrast, BlackRock’s ‘ETHA’, the largest by assets under management, was the only one to see outflows. ETHA recorded net outflows of $9.28 million, showing a selling bias for a second consecutive session.

The remaining five products—Grayscale (ETHE), Bitwise (ETHW), Franklin Templeton (EZET), Invesco (QETH) and 21Shares (TETH)—ended the session flat with no flows in or out.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Market] Bitcoin tops $70,000 intraday…Ethereum up 7% from prior day](https://media.bloomingbit.io/PROD/news/3db8b44b-58b3-4bd9-81b9-3c1882709ef5.webp?w=250)