Summary

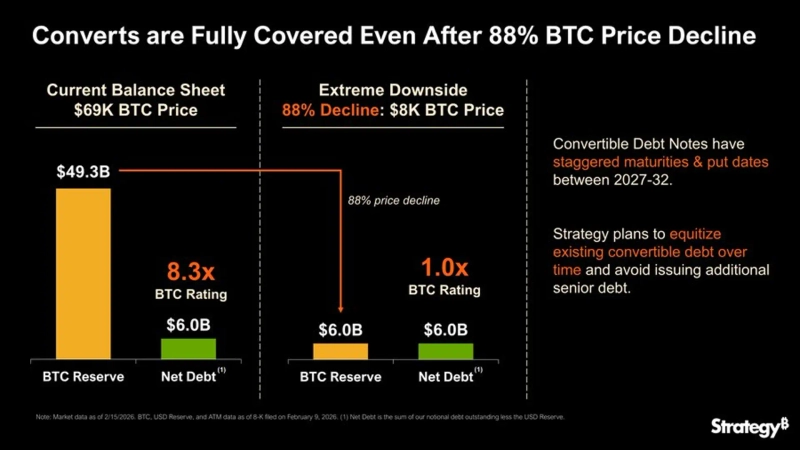

- Strategy said it holds sufficient assets to repay all debt in full even if the price of Bitcoin falls to $8,000.

- Strategy said it will pursue a plan over the next 3 to 6 years to convert convertible debt into equity to reduce its financial burden.

- Strategy said it is maintaining its cumulative Bitcoin purchases and long-term holding strategy, extending a 12-week consecutive buying streak despite heightened market volatility.

Strategy, a Bitcoin (BTC) treasury strategy company led by Michael Saylor, said it holds sufficient assets to repay its debt in full even if the price of Bitcoin were to plunge to $8,000.

On the 15th (local time), Strategy said via its official X account that "even if the price of Bitcoin falls to $8,000, we can fully cover our obligations," brushing aside market concerns about its financial health. Amid the recent correction, some have pointed to leverage risks among corporate Bitcoin holders.

The company said it will pursue a plan over the next 3 to 6 years to convert its convertible debt into equity. The move is seen as a strategy to gradually absorb existing debt into its capital structure and reduce financial burdens.

Meanwhile, Strategy continues its accumulation stance despite heightened market volatility. On the 15th, Saylor shared a chart of the company’s cumulative Bitcoin purchases on X, hinting at additional buying. The streak marks 12 consecutive weeks of purchases, reaffirming that it is maintaining a long-term holding strategy even during a price pullback.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Today’s key economic & crypto calendar] Japan’s preliminary Q4 GDP, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)