Summary

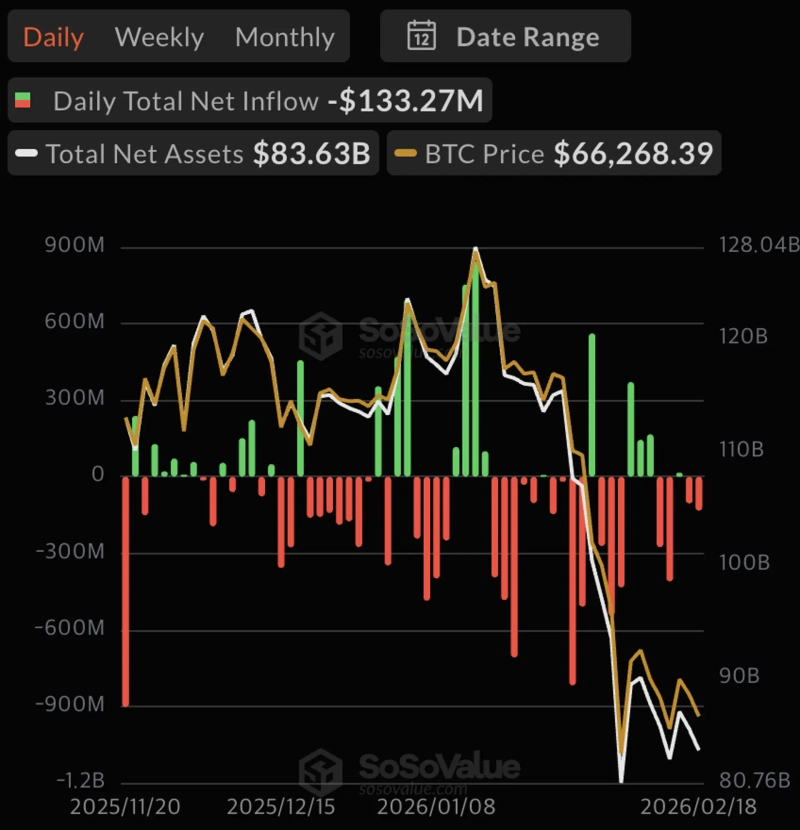

- About $10 billion has flowed out of U.S. spot Bitcoin ETFs over the past four months.

- Spot Bitcoin ETFs recorded net outflows for four consecutive weeks on a weekly basis, and for three straight months from November last year through January this year on a monthly basis.

- Even after funds flowed out following a 45% decline in Bitcoin prices, Wall Street’s relationship with Bitcoin has been positive overall, it said.

About $10 billion has flowed out of U.S. spot Bitcoin (BTC) exchange-traded funds (ETFs) over the past four months.

Eric Balchunas, Bloomberg’s senior ETF analyst, said on X that “cumulative net inflows into Bitcoin ETFs peaked at $63 billion in October last year,” adding that “(cumulative net inflows) are now around $53 billion,” he wrote on the 19th (local time). Balchunas said this “means a net $53 billion has flowed into (Bitcoin ETFs) over the past two years.”

Spot Bitcoin ETFs have been seeing sustained outflows recently. According to SoSoValue, spot Bitcoin ETFs posted net outflows for four consecutive weeks on a weekly basis. On a monthly basis as well, net outflows continued for three straight months from November last year through January this year.

However, the outcome was seen as exceeding industry expectations. Balchunas noted that “Bloomberg’s first-year cumulative net inflow estimate for (Bitcoin ETFs) was $5 billion to $15 billion.” He added, “given that funds flowed out (of ETFs) after Bitcoin prices fell 45% recently, it’s necessary to consider this context,” and said, “overall, Wall Street’s relationship with Bitcoin has been positive so far.”

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Analysis] "XRP exchange supply ratio declines…a re-accumulation signal"](https://media.bloomingbit.io/PROD/news/46850679-4c3d-4856-b46d-ea88bbd2b160.webp?w=250)