Summary

- The US spot Bitcoin ETF market reportedly turned back to net inflows after four trading sessions.

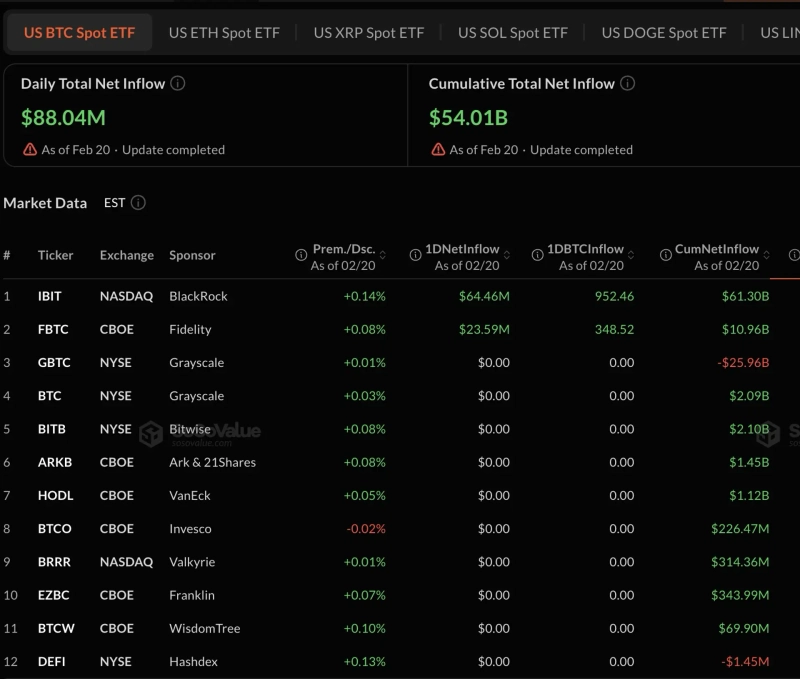

- Total daily net inflows into US spot Bitcoin ETFs were tallied at $88.04 million.

- BlackRock’s IBIT took in $64.46 million and Fidelity’s FBTC $23.59 million, according to the report.

The US market for spot Bitcoin exchange-traded funds (ETFs) swung back to net inflows after four trading sessions. Some institutional money appears to have returned even as volatility has recently intensified.

According to data from SosoValue on the 20th (local time), total daily net inflows into US spot Bitcoin ETFs came to $88.04 million.

By fund, BlackRock’s IBIT attracted $64.46 million, accounting for most of the net inflows. Fidelity’s FBTC also posted net inflows of $23.59 million. Other major ETFs, including Grayscale’s GBTC, Bitwise’s BITB and ARK’s ARKB, saw no inflows or outflows.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "Retail investors keep buying Bitcoin…a rally needs institutional demand"](https://media.bloomingbit.io/PROD/news/b774fc7b-a993-4be9-99a5-784ef5d5372d.webp?w=250)

![Trump, after ruling mutual tariffs illegal: “10% additional tariff on the whole world” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/6db53d1e-258b-487d-b3ae-a052b6e919cf.webp?w=250)