PiCK

Withdrawal, Tax Risk, and Political Uncertainty...KOSPI Faces 'Sixfold Hardship'

Summary

- After President Yoon Seok-yeol's unexpected dismissal of the non-permanent secretary, the Korean financial market was shaken.

- KOSPI index broke the 2500 mark, showing volatility.

- Political uncertainty poses an additional risk to the financial market.

Fluctuating Financial Market...Stock Market Weakens, Exchange Rate Rises

KOSPI Falls 1.4% to Break 2500 Mark

Exchange Rate Drops from 1442 Won to 1410 Won

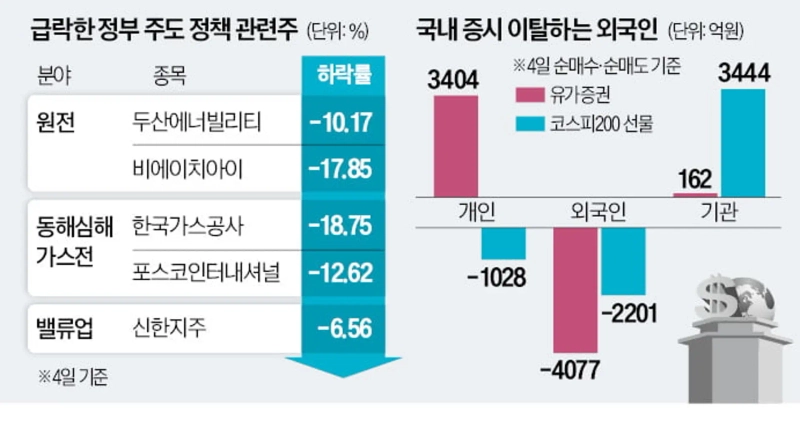

The political turmoil caused by President Yoon Seok-yeol's unexpected dismissal of the non-permanent secretary has shaken the domestic stock and exchange markets. The political uncertainty following the sudden political upheaval is expected to act as the biggest risk factor in the domestic financial market. On the 4th, the KOSPI index fell by 1.44% to close at 2464.0, breaking the 2500 mark. At one point, it fell by 2.31%. Following the announcement of President Yoon's dismissal, foreign investors rushed to withdraw their funds as the opposition party proposed a motion to impeach the president. Foreigners sold 642.6 billion won worth of stocks and bonds on this day. The KOSDAQ index also fell by 1.98%.

The won-dollar exchange rate (as of 3:30 PM) recorded 1410 won, down 7 won from the previous day. The previous night, it had risen to 1442 won following the dismissal announcement. Although the 'market collapse' was avoided as the dismissal was resolved within six hours, the domestic financial market is in a state of 'time-limited control' with no choice but to be in a state of 'time-limited control'. The analysis shows that the simultaneous contraction of exports and imports is expected to further reduce the earnings of major companies, and the political uncertainty is expected to worsen due to the 'tax risk' following the US Donald Trump administration's 'tax risk'.

Fluctuating Financial Market

Withdrawal Burden and Import Contraction Intensify...Policy Focus Shifts to Political Themes

"There has been no more severe situation than now when investing in domestic stocks. It seems that all kinds of bad news are being piled up, and political uncertainty has been added." (Representative of A Asset Management)

The domestic stock market, which recorded a 'profit rate collapse' throughout this year, has fallen into the 'sixfold hardship'. The simultaneous contraction of exports and imports is rapidly heading towards a negative adjustment in the performance of major companies. Here, the tax risk of the Donald Trump administration, the high-speed progress of the won-dollar exchange rate, and the domestic political risk have been further aggravated.

Nuclear Power and Defense Industry Policy Focus Rapidly Shifts

On the 4th, the KOSPI index fell by 1.44% to close at 2464.0. The market, which was not as big as expected, was affected by the unexpected dismissal of President Yoon's non-permanent secretary. The impact of the dismissal, which was resolved within six hours, was significant.

However, the political power quickly entered the sudden national face, and the domestic stock market fell into a state of 'time-limited control'. The domestic stock market, which is based on imports, is weak and is recording a profit rate collapse in the world's major countries this year. Even in the face of bad news, the domestic stock market is responding most severely, and a large bad news has been added.

The biggest problem holding back the domestic stock market is the simultaneous contraction of exports and imports. As a result, the earnings outlook of major companies is expected to continue to decline for the next year. The high-intensity tax policy of the Trump administration is also a bad news for the domestic economy, which is centered on import companies.

If the sudden political upheaval becomes more serious, the main national policy issues that the government has been actively pursuing are likely to become 'all-stop'. On this day, the representative national policy issues of the Yoon administration were rapidly shifted. Doosan Enerbility (-10.17%), BAE Systems (-17.85%), etc., related to nuclear power, Korea Gas Corporation (-18.75%), POSCO International (-12.62%), etc., related to 'big king trade', were all down. Shinhan Financial Group (-6.56%), etc., related to the defense industry (excluding corporate value), also fell. In the stock market where the main stock price has disappeared, only political themes are flying. On this day, Orion Jeonggong and Su-san Aiyanti, A-Tec, and Eastarco, which are classified as 'Lee Jae-myung theme stocks', hit the upper limit.

"Won-Dollar Exchange Rate Volatility Will Increase"

The bond market is also unstable. According to the Financial Investment Association, the national bond yield for 3 years rose by 0.041% to 2.626% on this day. The yield on AA- rated corporate bonds for 3 years also rose by 0.041% to 3.21%. Although the financial authorities urgently announced measures such as liquidity supply, the bond market experts' analysis is that the uncertainty of interest rates is not being resolved.

The corporate bond market is also fluctuating. As the year-end fiscal cliff (accounting chief's remarks) is expected, there is a judgment that the liquidity supply will be difficult due to the contraction of investment sentiment. Companies preparing for year-end cash settlements are expected to delay their schedules to early next year due to the uncertainty of corporate bond demand.

The won-dollar exchange rate, which started at 1418 won, up 15 won from the previous week's closing price (as of 3:30 PM), moved around 1415 won, but fell to 1410 won at the end. The uncertainty following the dismissal was quickly resolved in the night trade, and the Bank of Korea opened a temporary financial stabilization committee and announced a liquidity supply plan through the purchase of foreign exchange repurchase agreements (RP) as a result of the analysis.

The mid- to long-term volatility of the won-dollar exchange rate is expected to increase. If the sudden political upheaval becomes more serious, it is difficult to prevent the situation where the exchange rate temporarily rises due to issues such as the government's leadership reshuffle. NH Investment & Securities' Wi Jae-hyun economist said, "If political uncertainty increases, the 'sell Korea' phenomenon centered on foreign funds may accelerate."

Shim Sung-mi/Kang Jin-kyu/Jang Hyun-joo Reporter smshim@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Jobs surprise and AI overhang collide…Fears grow of rising volatility as Bitcoin meets $70,000 resistance [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/95764d70-5a3d-4300-b834-25c6a366c3a5.webp?w=250)

![Evernorth: “XRP Is Central to Next-Generation Finance…A Downturn Is a Buying Opportunity” [Cointerview]](https://media.bloomingbit.io/PROD/news/3c5ebde2-c604-4886-aa3e-b8c1e0c600c4.webp?w=250)