PiCK

When the exchange rate hit 1,429 won, authorities seemed to intervene... Will foreign reserves fall below $400 billion?

Summary

- It was reported that as the exchange rate surged, foreign exchange authorities intervened in the market by selling dollars.

- It was assessed that there is a concern that Korea's foreign reserves could fall below $400 billion.

- It was stated that due to political uncertainty, exchange rate volatility is expected to continue for the time being.

Han Dong-hoon's mention of 'Yoon's suspension' causes surge

Large volumes poured out ahead of 1,430 won

Political uncertainty shakes foreign exchange breakwater

When the exchange rate hit 1,429 won, authorities seemed to intervene... Will foreign reserves fall below $400 billion? As the possibility of President Yoon Suk-yeol's impeachment increased, the foreign exchange market fluctuated significantly. The won-dollar exchange rate surged to around 1,430 won (the value of the won plummeted) after Han Dong-hoon, the leader of the People Power Party, mentioned the need for the president's suspension, but the rise gradually narrowed. Foreign exchange market insiders analyzed that the foreign exchange authorities intervened in the market by selling a large amount of dollars during this process.

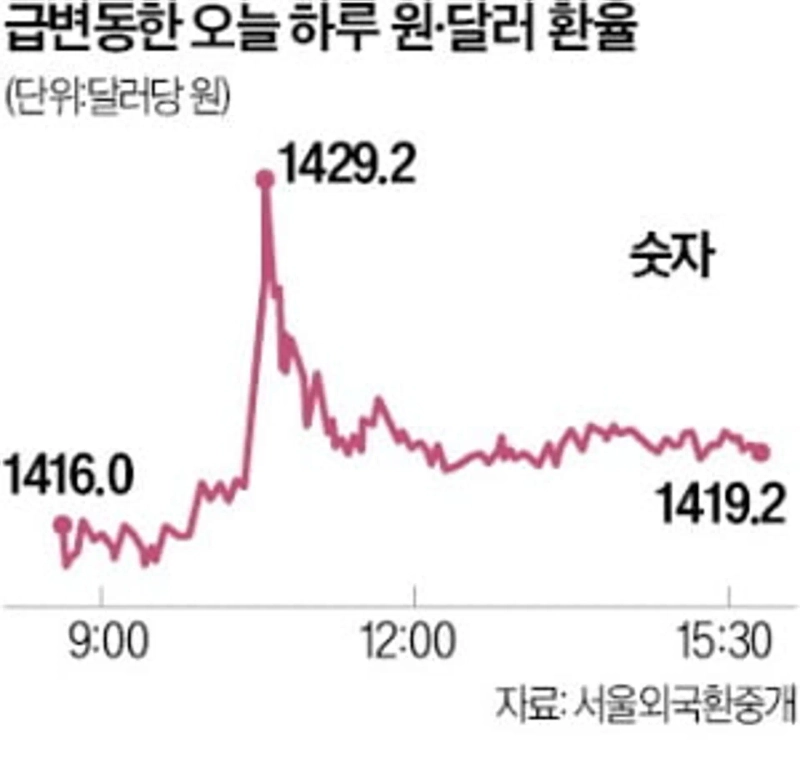

On the 6th, the won-dollar exchange rate in the Seoul foreign exchange market (as of 3:30 p.m.) ended weekly trading at 1,419.20 won, up 4.10 won from the same time the previous day. Although the closing price did not rise significantly compared to the previous day, the intraday volatility was extreme.

The won-dollar exchange rate started at 1,416 won that day, up 90 jeon from the previous day's weekly trading. The exchange rate surged from 10:35 a.m. to reach an intraday high of 1,429.20 won at 10:53 a.m. This was influenced by predictions that President Yoon's impeachment could be expedited as Han reversed his stance from 'opposing impeachment,' and the Democratic Party of Korea raised the possibility of a 'second martial law.' The rise in the dollar index in the Asian financial market that morning also contributed to the surge in the won-dollar exchange rate.

The appearance of an exchange rate in the 1,420 won range during weekly trading was the first time in two years and one month since November 4, 2022. Although the exchange rate rose to 1,442 won in overnight trading after the martial law declaration on the 4th, it is analyzed that overnight trading is less representative due to low trading volume, which can easily lead to skewness.

As the exchange rate rose sharply, it was reported that foreign exchange authorities, including the Ministry of Economy and Finance and the Bank of Korea, intervened by selling dollars. A securities company official explained, "A large amount of sell orders came out ahead of 1,430 won," and "it is presumed to be due to government intervention." As a result, the exchange rate fell back to the 1,410 won range.

Initially, foreign exchange authorities assessed that the exchange rate, which soared in the overnight market on the day of the martial law declaration on the 3rd, gradually stabilized and hovered in the 1,410 won range. Rhee Chang-yong, the governor of the Bank of Korea, told reporters on the 5th, "If there is no special shock, the exchange rate will slowly go down." However, as the possibility of impeachment increased that day, the exchange rate fluctuated, and the authorities' vigilance is expected to continue for the time being.

The intervention capacity of the foreign exchange authorities is evaluated to be sufficient. As of the end of November, foreign reserves amounted to $415.39 billion, a decrease of $300 million from the previous month. As of the end of October, Korea's foreign reserves ranked 9th in the world.

If exchange rate volatility increases due to the impeachment situation, the authorities' intervention in the foreign exchange market is expected to increase this month, which is a concern. Previously, during the Legoland incident in the third quarter of 2022, foreign exchange authorities net sold $17.5 billion over three months to stabilize the foreign exchange market.

If foreign exchange authorities need to intervene in the foreign exchange market on a similar scale, there is concern that foreign reserves could fall below $400 billion in the coming months.

The last time foreign reserves recorded in the $300 billion range was at the end of May 2018 ($398.98 billion), and it has not happened once in six years and six months.

Kang Jin-kyu, josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Evernorth: “XRP Is Central to Next-Generation Finance…A Downturn Is a Buying Opportunity” [Cointerview]](https://media.bloomingbit.io/PROD/news/3c5ebde2-c604-4886-aa3e-b8c1e0c600c4.webp?w=250)