Summary

- The US labor market is showing stability, raising expectations for a rate cut by the Fed.

- Non-farm jobs in November exceeded experts' expectations, increasing the likelihood of a 0.25% point rate cut by the Fed at this FOMC.

- According to data from the Chicago Mercantile Exchange, the probability of a rate cut rose to 89.3% after the employment data was released.

230,000 Non-farm Jobs Increased in November

Recovery from Boeing Strike and Hurricane Impact

Fed Weighs 0.25%P Cut This Month

As the US labor market continues its moderate expansion, expectations for a rate cut by the US Federal Reserve (Fed) this month have grown.

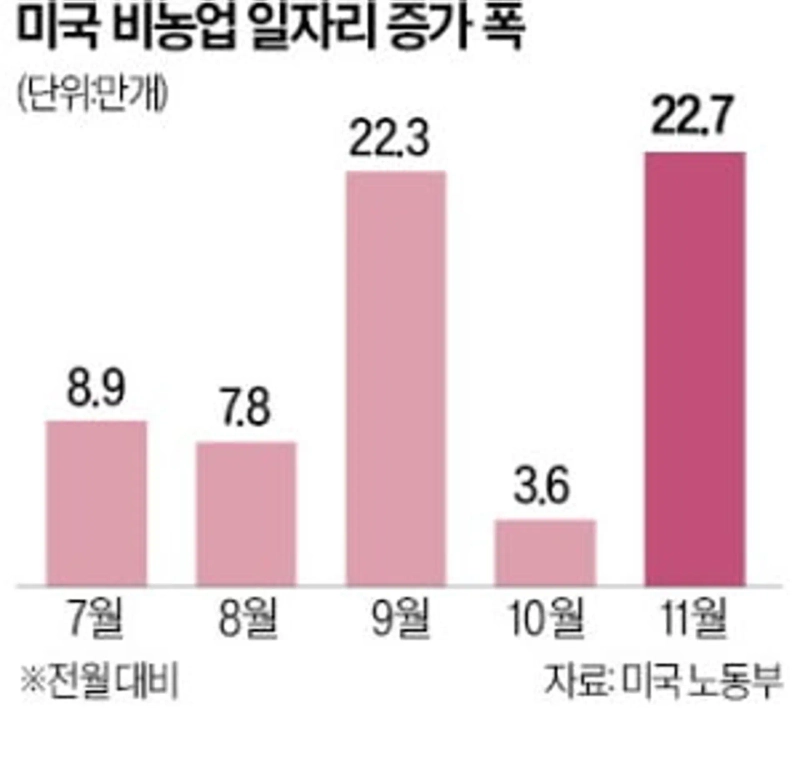

Stabilized US Job Market... Expectations for Rate Cut Grow According to the US Department of Labor on the 6th, non-farm new jobs increased by 227,000 last month compared to the previous month. This exceeded experts' estimates and recovered from the shock of only 12,000 job increases due to Boeing's strike and hurricane impact in October. Last month's job increase was revised to 36,000. The unemployment rate in November slightly rose to 4.2%, as expected by experts. The hourly average wage growth rate was 0.4% compared to the previous month, exceeding the estimate of 0.3%.

By industry, transportation equipment manufacturing increased by 32,000 last month. This is interpreted as being influenced by the return of Boeing workers who went on strike.

As the labor market aligns with experts' expectations, the anticipation for a rate cut at the last Federal Open Market Committee (FOMC) of the year, scheduled for December 18-19, has grown. Jerome Powell, the Fed Chairman, recently stated at the New York Times DealBook Summit that "the US economy is in very good shape" and "will be cautious about future rate cuts." According to the Chicago Mercantile Exchange (CME) FedWatch, after the employment data was released, the probability of a 0.25% point rate cut at this FOMC rose to 89.3%. Before the employment data announcement, the probability of a 0.25% point cut was 68.6%, and the probability of holding steady was 31.4%. The US 2-year Treasury yield fluctuated around 4.16% in the early session and fell to 4.089% within 30 minutes after the job data release.

However, Reuters added that "due to the uncertainty of the new administration's policies under President-elect Donald Trump, the possibility of further rate cuts in 2025 is low."

Reporter Hyunil Lee hiuneal@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Evernorth: “XRP Is Central to Next-Generation Finance…A Downturn Is a Buying Opportunity” [Cointerview]](https://media.bloomingbit.io/PROD/news/3c5ebde2-c604-4886-aa3e-b8c1e0c600c4.webp?w=250)