[Analysis] "Yesterday's Bitcoin Crash Caused by Futures Market Leverage Unwinding"

Doohyun Hwang

Summary

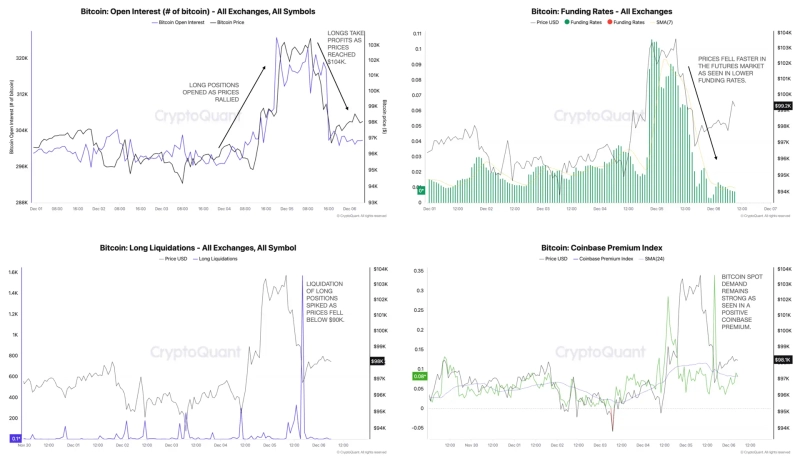

- The temporary crash of Bitcoin was attributed to the unwinding of leverage in the futures market.

- It was reported that along with Bitcoin's decline, open interest decreased, and long positions in the futures market were liquidated.

- Despite the price drop in the futures market, spot demand remains strong.

The temporary crash of Bitcoin on the 5th (local time) was analyzed to be due to the unwinding of leverage in the futures market. At that time, Bitcoin fell to $90,500 based on the Binance Tether (USDT) market.

On the 6th, Julio Moreno, an analyst at CryptoQuant, stated on his X, "Open interest decreased along with the price drop, and long positions in the futures market were liquidated," confirming this analysis.

He added, "The funding rate also fell. This means that the futures price fell faster than the spot price," and noted, "Unlike futures, spot demand remains strong."

Meanwhile, Bitcoin is trading at around $102,000 on Binance, up approximately 3.1% from the previous day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)