Editor's PiCK

“Ripple, High Trading Volume in Korea... But Global Market Drives Uptrend”

Summary

- Ripple's recent 480% increase was attributed to global economic conditions and the peculiarities of the Korean market.

- The trading volume of Ripple on Korean exchanges significantly surpassed other coins, proving investors' interest, but the core uptrend was led by Coinbase.

- The virtual asset market, due to its global nature, is not greatly affected by a country's political situation, and Korea's political instability has a limited impact.

Web3 consulting firm Dispread recently released a report on the 12th that deeply analyzes the factors behind Ripple (XRP)'s price increase, dividing them into global economic conditions and the peculiarities of the Korean market.

In November, Ripple rose from $0.5 (approximately 717 KRW) to $2.9 (approximately 4161 KRW) on Binance, recording an increase of about 480%. The report identified the high trading volume in the Korean market as a partial cause of the Ripple price increase.

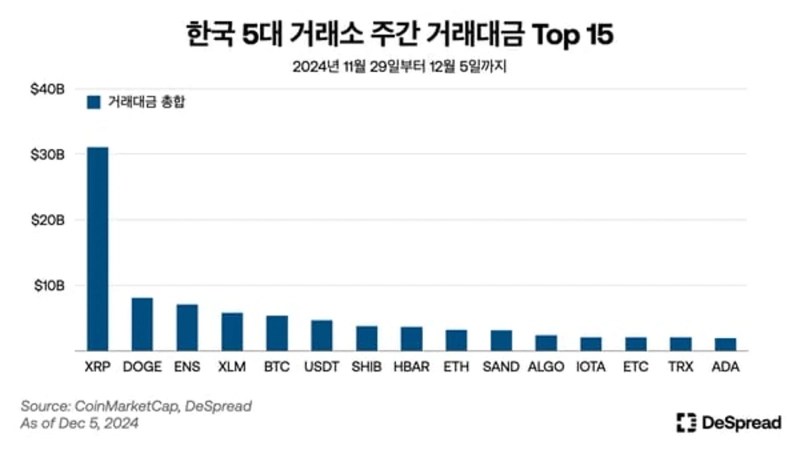

From November 29 to the 5th, the total trading volume of Ripple on the top 5 domestic exchanges (Upbit, Bithumb, Korbit, Coinone, GOPAX) was $31 billion (approximately 44.4757 trillion KRW). Ripple's trading volume significantly surpassed that of Dogecoin (DOGE), which recorded the next highest trading volume of $8 billion (approximately 11.4776 trillion KRW), proving the high interest of domestic investors.

According to the report, some point to the news of a two-year postponement of virtual asset taxation as one of the reasons for the surge in Ripple's trading volume. Previously, the Democratic Party agreed on December 1 to amend the Income Tax Act to postpone the taxation of virtual asset income by two years and decided to handle it in the plenary session. This was the first agreement made after the government announced in July that it would postpone the taxation of virtual asset income from January 2025 to 2027 along with the announcement of the tax law amendment.

However, the research team cited CryptoQuant CEO Ju Ki-young's statement that “there is an on-chain indicator showing that a minute-level price premium for Ripple occurred significantly on Coinbase, leading to the uptrend of Ripple in early December,” analyzing that Ripple's uptrend was not solely due to the Korean market.

The global factors for Ripple's rise identified by the research team include ▲ expectations for easing virtual asset regulations due to Donald Trump's election ▲ compliance with the ISO20022 standard ▲ the announcement of the resignation of SEC Chairman Gary Gensler.

Meanwhile, the research team analyzed the impact of the emergency martial law declaration in Korea on the domestic virtual asset market on the 3rd. After the martial law announcement, a large-scale selling trend among domestic investors continued, and the price of Bitcoin (BTC) on Upbit fell by up to 16% compared to Binance. The prices of major virtual assets, including Ripple, also plummeted in the short term but quickly recovered and stabilized after the martial law was lifted.

Dispread Research stated, “Virtual assets are inherently global in nature, and the impact of political instability in countries like Korea on the entire market is limited,” analyzing that “unless it is an economic powerhouse like the United States, the influence of a country's political situation on this market will be minimized.”

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)