Summary

- It was reported that the new funds inflow into Ripple and Dogecoin is increasing, interpreted as a bullish signal.

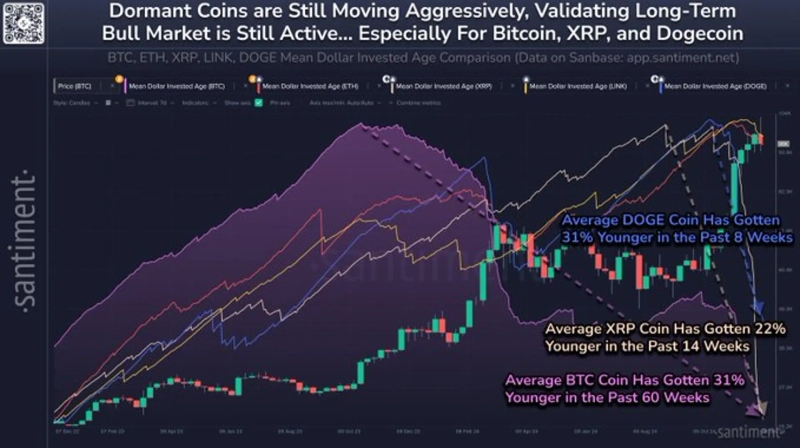

- According to Santiment, the average dollar investment age indicator is declining, indicating new capital inflow.

- The increase in network activity and asset circulation has historically acted as early signals of a bull market.

Recently, it has been revealed that new funds are being injected into several cryptocurrencies, including Ripple (XRP) and Dogecoin (DOGE). There is also analysis suggesting that this could be interpreted as a bullish signal.

On the 12th, the on-chain data analysis company Santiment released the average dollar investment age indicator for cryptocurrencies via X (Twitter). The average dollar investment age indicator represents the period during which dollar funds have been invested in a specific cryptocurrency.

According to the data, this indicator has recently dropped significantly for Ripple, Dogecoin, and Bitcoin (BTC). Dogecoin has decreased by 31% over the past 370 days, Ripple by 22% over 865 days, and Bitcoin by 31% over 439 days.

Santiment explained that this could be seen as a signal that existing holders are selling and new capital is flowing in. Specifically, "The decrease in the network's average dollar investment age means that dormant cryptocurrencies in old and stagnant wallets are being recirculated, and at the same time, network activity has increased," they said.

Santiment added, "These indicators have historically acted as early signals of a sustained bull market," and "It shows that asset circulation and new capital inflow are occurring healthily."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)