Summary

- It was revealed that the activity of virtual asset traders is decreasing, and a tendency to avoid risk is being observed.

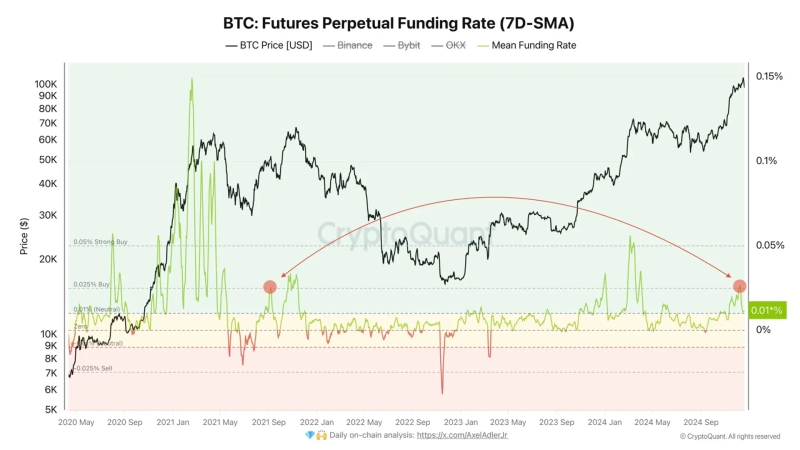

- In the past seven days, $216 million in long positions have been liquidated on major exchanges, which is significantly less compared to 2021.

- The current funding rate is positive, but it is being maintained at a lower level compared to past bull markets.

There are claims that the activity of virtual asset (cryptocurrency) traders is decreasing, and there is a growing tendency to avoid risk.

On the 20th (local time), Axel Adler Jr., a contributor to CryptoQuant, stated on X, "Virtual asset traders are avoiding risky behavior unlike in the past," and evaluated that "their activity is decreasing, and they are showing a more cautious attitude."

He reported, "In the past seven days, $216 million in long positions have been liquidated on Binance, Bybit, and OKX," adding, "This is 15 times less than the liquidation cluster in 2021." He further explained, "The current funding rate is positive, but it is significantly lower than the peak levels of 2021," and "the scale of liquidations in the bull market is also maintaining a low level."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)